March 10, 2022

“We must let go of the life we have planned, so as to accept the one that is waiting for us.” –Joseph Campbell (Campbell coined the phrase: “follow your bliss”)

THANK YOU, THANK YOU FOR DONATING TO THE SPECIAL OLYMPICS FUND DRIVE.

MICHAEL CAMPBELL AND I WERE ABLE TO RAISE $43,800 DOLLARS. THE SILLY VIDE0 WE DID HAS GONE VIRAL…HA-HA. SEE THE GREAT DANCE….

https://www.youtube.com/watch?v=vSVO86oX4Hw

Because of the blog on Special Olympics, our survey was lost (not noticed by) too many readers. While we did get 230 replies, we usually get more than 1400.

The survey every year has helped us continue with what you like to read, delete what you do not and incorporate new suggestions. Your help is really very much appreciated…Take 6 minutes. Do it! Share your opinion: Take The Survey

Be it good, bad, or ugly. We extended the reply date to March 15, 2022. Oh, you still could win one of 20 Ozzie’ books.

Our Zoom evening “Forecast 2022” on February 24, 2022…was attended by 463 people, half of which asked questions after! We also received over seventy messages of people that could not attend and people that never subscribed but wanted to see the video.

Sorry, no can do. Next one April/May.

TOPICS

- RUMOURS: HELOCS OR ANY GIFTS CANNOT BE USED AS DP ON INVESTMENTS

- RUMOURS: DOWNPAYMENTS FOR INVESTORS TO BE INCREASED TO 35%

- WHAT THE WAR COULD MEAN TO REAL ESTATE INVESTMENTS

- MARKETS ARE SHIFTING

- NOTE ASTOUNDING NEW LISTINGS IN THE VALLEY

- EXPECT LISTINGS TO CONTINUE TO INCREASE

- THE NUMBERS, THE NUMBERS, VANCOUVER, AND THE VALLEY – FEBRUARY 2022, 2021, 2020, 2019

- MAJOR CANADA REAL ESTATE MARKETS

- CANADA DOLLAR DOWN EVEN THOUGH OIL IS UP

- US DOLLAR

- QUESTIONS – WAR – GOLD – FINANCIAL SYSTEM CRACKS

- BOOK OF THE MONTH – HELPS YOU POSITION YOUR REAL ESTATE

- SONG/MUSIC OF THE MONTH – SOMETHING TOTALLY DIFFERENT

- BINGEWORTHY TV SHOW

- RANT OF THE MONTH – REVENGE OF THE LITTLE MAN

- RUSSIA DEFAULTING ON ITS DEBT

INTERNATIONAL

The war in Ukraine has generated a torrent of questions, comments, admonitions, and speculations.

Particularly the questions on outlook for global war, the stability of the Global financial system, gold, silver, bitcoin, and oil abounded.

Some of you seem to think I actually know the answers. I do not. All you get is an opinion. Also remember I am only interested in what and where worldwide action may influence investments in general and real estate in particular are impacted, i.e., inflation, immigration, interest rates etc.

The stability of the Global financial system is indeed a big question. It’s rocking and rolling the last 4 weeks demonstrates that many countries, corporations, and individuals have no confidence in the world. You see gold and the US dollar go up together when normally do not. Money is rushing to the safety of the US. A massive move up in the dollar in a week, Oil with $20 a day swings now at $130… Gold up sixty-five dollars in a day!

You shake your head and with it all preconceived outcomes come into question. Add to this the flattening of yield curve, the Eurodollar future market inversion getting worse and repo sales spiking … Cracks everywhere. The possible outcomes and scenarios are too many to assess much less to predict a result.

Major Point: As crazy as this world is, it has some good points. There is a new unity in the west. A realization that mad men must face strong opposition. Germany finally owns up to its commitment to NATO (Trump’s shaming them did not work, Russian lunacy did), all European countries are closer together. So many countries and individuals helping and being outraged by Russia. The idea that mad men no longer exist is dead … calls for remembering Chamberlain and Hitler … comparing the peaceful Biden and Putin to the historical ones… with perhaps predictable outcomes. Weakness does not work with despots. We re-learn that complacency is not an option. Now, everything seems to be on the table.

But it makes all of us stronger, it is people who made their corporations leave Russia – worldwide. We the people got a wake-up call. We have entered into an economic war with Russia. Your murders will be exposed. We will be together, and we will be relentless. And we will win. High gas prices be darned.

In my view, we will muddle through as we did in all other crises. We will be scarred, but we will win!

SINGAPORE

Property prices in Singapore have climbed in the past two years and will likely keep going up despite the government’s efforts to cool the market, CNBC reported. Private residential prices could rise between 1% to 3% in 2022, according to Leonard Tay, head of research at real estate agency Knight Frank Singapore. Prices of public housing flats on the resale market also popped 12.7% last year, data from the Housing and Development Board showed. In a bid to cool the red-hot private and public residential property market, Singapore introduced new measures in mid-December. They included higher taxes on second and subsequent property purchases and tighter limits on loans.

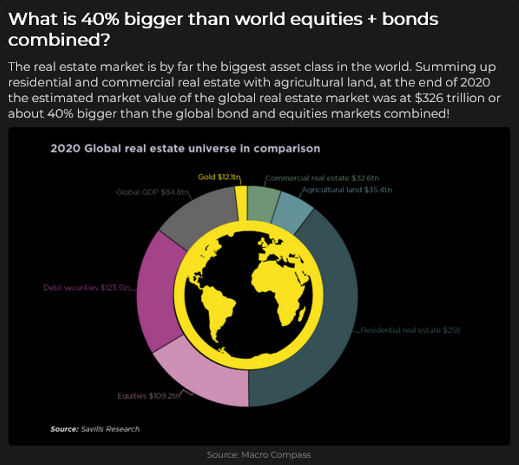

WHAT’S THE BIGGEST ASSET IN THE WORLD?

US REAL ESTATE

NAR: The national inventory of active listings declined by 24% over last year, while the total inventory of unsold homes, including pending listings, declined by 15%. The inventory of active listings was down 62% compared to 2020 before the onset of the COVID-19 pandemic.

- Newly listed homes were down 0.5% nationally compared to a year ago, and down 0.7% for large metros over the past year. While annual new listings growth was on the verge of being positive, sellers still listed at rates 13.8% lower than typical 2017 to 2020 levels prior to the pandemic.

- The February national median listing price for active listings was $392,000, up 13% compared to last year and up 27% compared to February 2020. In large metros, median listing prices grew by 8% compared to last year, on average.

- Nationally, the typical home spent 47 days on the market in February, down 17 days from the same time last year and down 32 days from February 2020.

Looks still like a very strong market – where affordability still works with lower than Canadian prices – buying still cheaper than rent (see last month and below).

Realtor.com’s February housing data release reveals that the housing market is heating up unusually early this year. The national median listing price has reached a new high which surpassed last year’s July seasonal high and time on market is declining faster than usual heading into the spring season.

This signals a competitive early spring season for homebuyers.

However, inventory trends are starting to show an improvement, as the rate of decline in inventory has slowed and a handful of metros across the country are seeing inventory increase. We also expect more sellers to enter the market next month as more newly listed homes came onto the market in the last weeks of February than the same time last year.

In the 50 largest U.S. metro areas, median rent rose an astounding 19% from December 2020 to December 2021, according to a Realtor.com analysis of properties with two or fewer bedrooms. And nowhere was the jump bigger than in the Miami metro area, where the median rent exploded to $2,850, 49.8% higher than the previous year! Values grow where people go … where people go rents rise too!

FROM MIKE’S MONEYTALKS

President Biden says Ukraine crisis is a reminder that we must be energy independent. No word on whether he passed that on to Quebec, Atlantic provinces, anti-pipeline groups & politicians who prefer importing oil from Saudi Arabia, Azerbaijan, Nigeria, Ivory Coast, the US & UK. https://omny.fm/shows/money-talks-with-michael-campbell

(2) BOOKS OF THE MONTH

Essentialism: The Disciplined Pursuit of Less by Greg McKeown

It’s a good read for all of us, who forever take on more and more, say ‘maybe’ instead of ‘no’… and do what is essential. Life changing!

- Fengshui for Real Estate Property Selection by Jerry King and Vicky Lee. Illustrations accompanied by explanations of what is good Feng Shui vs. bad Feng Shui. Where to place rooms, buildings, which shapes etc. Vancouver Feng Shui Master tells all.

SILLY CORNER

The numbers game. A man is strolling past a lunatic asylum when he hears a loud chanting. ‘Thirteen! Thirteen! Thirteen!’ goes the noise from within the mental hospital’s wards.

The man’s curiosity gets the better of him and he searches for a hole in the security fence. It’s not long before he finds a small crack, so he leans forward and peers in. Instantly, someone jabs him in the eye. As he reels back in agony, the chanting continues: ‘Fourteen! Fourteen! Fourteen!’

BITCOIN? What is it? Could we just make a new brand of Corn Nuts and call em Bit-Corns?

BINGEWORTHY TV SHOW

GOLIATH

We liked the 4 seasons of Goliath. Washed up lawyer Billy McBride takes on bad actors.

SONG/MUSIC OF THE WEEK

Question and comment. I loved your recommendation on songs and some of them (like Alizee) were unknown to me and now loved. Yes, greatest song and dancer. (Here it is again https://www.youtube.com/watch?v=xDDpNaQxn6E)

On your Blip channel you feature several orchestral and opera pieces. Why not here?

A: OK, here goes: Orchestral pieces that I like will also rate by the conductor. A superb conductor enables the already very talented orchestra players to play together. It is a given that the players are already virtuosos, but to get them to depend on each other so that the conductor disappears into the music, that’s what I look for.

I love the British conductors Simon Rattle (who conducts the Berlin Philharmonic) and the German Klaus Tennsteddt (RIP) who conducted the London Philharmonic (go figure).

On these Wagner pieces – there is nowhere to hide…

We are so fortunate that both these and many other great conductors can be found on YouTube (past and present)

- Lohengrin Overture – directed by Simon Rattle – Berlin Philharmonic. One of the most beautiful harmonies of all classical music. https://www.youtube.com/watch?v=zyodilzeqfg

- I also love Choruses. I saw the Cologne (my hometown) Male Chorus as a boy and always enjoyed their presentations/interpretations. Today I found their Tannhäuser Pilgrims Chorus… Sensual love versus spiritual love. https://www.youtube.com/watch?v=972gxnqvjpc

RANTS OF THE WEEK AND THE REVENGE

The ‘revenge of the little man’ means that what are you to do when some powerful individual or corporation does something to annoy you. You take revenge (even though they don’t know. You do!) Share your annoyances and the revenge you took.

- In YouTube we call bombastic headline “clickbait”…designed to get you to click and watch. Well, we have the same garish headlines in the news from newspapers, news and media outlets that put up a bombastic headline, but when you click on it you get a few teaser sentences, then “subscribe to this paper or that NewsChannel first”…Arrgh. Don’t send me the click bait headline. That’s like Lucy taking away the ball from Charlie at the last minute.

REVENGE? There is revenge needed. The only revenge for the little man is: “Block them, don’t just delete BLOCK them”.

- We have paper bags now. I get it – we want to get rid of plastic. (Although, what about saving trees?) Anyhow, Safeway has brown bags, IGA has brown bags and Whole Foods does also, The same right? NO, Safeway bags have no handles. But what really annoys me is that check out ladies seem to get trained to TRAIN me to fill out my own bag. I get the bag in front of me and a telling look.

REVENGE? Even though its really close, we drive to IGA or even Whole Foods. Bags designed for customers and friendly non judgemental check outs … with smiles.

Next month we deal with the whole questions of being trained (prompted by a reader). We, the consumers are checked, relentlessly bombarded, every little detail about us is known. It will blow your mind.

COMMENTS AND QUESTIONS

Q: ALL INFLATION – RUNAWAY QUESTIONS – WHAT WILL HAPPEN?

I DIRECT YOU TO LAST 3 MONTHS ISSUES 64-67.

“A government which robs Peter to pay Paul can always count on Paul’s support.” –George Bernard Shaw

Q: STILL QUESTIONS ON ‘WITHER THE US DOLLAR.’ LIKE THESE: ‘EMERGING MARKET COUNTRIES SIMPLY CANT AFFORD A HIGHER DOLLAR ‘. ‘THE US DEBT MEANS A COLLAPSE IS COMING,’ ETC.ETC.

A: Again, I am not a currency analyst! However, I stated over and over that in tough times, bad money wants to be changed into ‘good ‘money.’ The US dollar remains a reserve currency – valued as such by individuals around the world. In tough times they flee into the dollar. More money coming in drives up the value. Period. We see that continue.

Again also: Remember, you get to play with your own money, so you make your own decisions.

Q: CANADIAN DOLLAR

A: We said this last month: “We see the Canadian dollar still tied mainly to oil and commodities. As oil will fall (after the winter) we see the Canadian dollar come down.” Now to my great surprise, the Canadian dollar is going down (no surprise) but it goes down while oil is going up…strange. The reason? The Canadian dollar is going down against the US dollar, but not against most other currencies.

Q: HOW CAN PUTIN DEFAULT ON HIS BOND PAYMENS OF TRILLIONS OF DOLLARS AS IT DID BEFORE?

A: 1. Russia owes a lot less – perhaps around 450 billion. 2. He is not defaulting (yet). He will pay interest and debt repayments – but in rubles. 3. The Bolsheviks defaulted 100 years ago. Russia only defaulted on internal debt – so far.

Interesting point: China also let its developers’ default (for all intents and purpose) on foreign debt but not local debt.

Q: HERE IS A QUESTION: IS THERE ANY HOPE FOR SMALL CITIES IN WESTERN CANADA (EG. LLOYDMINSTER SK/AB)? THE REAL ESTATE MARKET HAS TANKED AND NOT RECOVERED: INVESTMENT OPPORTUNITES OR DYING COMMUNITY?

A: Our basic principle when picking a town is: Values grow where people go. People go where there are jobs no or coming. Lloydminster is a small border town. The SK looks worse than the Alberta side. The moment you cross the boarder the age of everything seems to drop by 40 years. Possibly due to taxes. With the tax climate in AB everyone wants to be on the AB side. But even the Alta side is dependent on agriculture and oil. It’s cyclical, perhaps with oil and commodities soaring thee is an upside, but as an investor I would stay in the major markets in AB.

O: I WOULDN’T HUMOUR PEOPLE THAT ASK YOU TO BACK UP YOUR WRITING. DO THEY THINK YOU MAKE IT UP? TELL EM TO GET LOST

A: Ha-ha. I am by answering the question.

Q: THIS QUESTION KEEPS COMING UP: I DO NOT UNDERSTAND THAT I NEED TO SIGN IN ON JCIR.CA TO GET INVITED TO SEE YOUR ZOOM FORECASTS. YOU ALREADY HAVE MY EMAIL AT OZBUZZCA.

A: We do not want to send out 26,000 Zoom invitations. If interested, you must subscribe and click an answer to the questions.

Q: I HEAR ABOUT META VERSE GAMES. YOU EXPLAINED WHAT A METAVERSE IS. BUT I HEARD OF A METAVERSE GAME?

A: You mean the game “Sandbox”? The Sandbox is an Ethereum-based decentralized NFT gaming metaverse that enables non-tech savvy users to create, sell, use, and monetize their own virtual reality NFTs. The crypto metaverse uses its native token SAND to underpin the entirety of the in-game economy. Sandbox is one of the leading meta verse games (Buy land, sell land, run around with your avatar.) I will start playing in it and report more next month or join yourself.

Q: YOUR CONSTANT “THE HIGH IS IN PLACE,” SHOWS NO BACK UP FOR YOUR STATEMENT. WHAT DO YOU SEE?

A: My answer last month said it all! This month read the Fraser Valley Board report (below).

Q: I DISAGREE WITH YOUR RUNAWAY INFLATION IN REAL ESTATE COMMENTS. IF IT IS A RUNAWAY, WE WOULD BE IN THE MILLIONS.

A: You are entitled. And we are – in the millions! Surrey SF home from $1,050,000 to 1,900,000 is runaway inflation.

But another reader sent this:

BLOOMBERG ECONOMICS DROPPING AN INFLATION BOMB:

“We now project the February CPI to show an increase of 8.0% year over year and top out in the vicinity of 9% in March or April.” But if energy prices continue to rise “CPI could rise above10%.” Interestingly, Black Rock CEO Fink said on March 9:“I would not be surprised if CPI reaches 9%!

And yes, on March 10, the US official inflation rate clocked in at 7.9%. BTW Turkey’s inflation rate was 50% in February alone! Russia’s (filtering in the crash in the ruble…is 99%! Cars cost 17% more in one week).

Q: LOVED THE DETAIL ON YOUR CHINA ITEMS. KEEP UP THE GOOD WORK.

A: Thanks. The world is aflame.

Q: DO IT NOW! AGREED. THIS YES AND THEN NO GAMES DON’T HELP ANYBODY

A: It got worse, when our Finance minster stated a date: “March 2” at which they would raise rates. That drove the last few buyers into mad offer markets.

Q: DON’T YOU AGREE THAT REALTORS ARE AT LEAST IN PART TO BLAME FOR THE CRAZY PRICES, WELL OVER ASKING?

A: Actually yes. It is a dance where buyers have a strong demand and owners are in the driver’s seat. But some realtors manage the process further. Say the last sale of a condo in a specific building last month was $500,000. So, a realtor can list it at say $525,000 to allow for price increases since the last few sales. Or he/she could list/manage it at $470,000. Buyers sit up at the “come on” price, particularly if they can only see it for one day and ‘all offers must be presented’ by the next day after. So, they are urged to increase their bid and that’s how come there are 10 or more offers. Often the listing at $470,000 sells for more than the $550,000, while the $525,000 one just sits and does not attract offers. It’s a game where there are no guilty or innocent parties. Everyone participates with eyes wide open. However, in this mad world there will be a peak… There will be demand destruction in a recession in this and many areas of the economy.

“Successful people do what unsuccessful people are not willing to do. Don’t wish it were easier; wish you were better.” –Jim Rohn

Q: YOU MENTIONED THAT YOU HAD KNOWLEDGE OF DOWN PAYMENTS FOR INVESTORS TO BE INCREASED TO 25% AND POSSIBLY AMORTIZATION PERIOD SET DOWN TO 20 YEARS. MY MORTGAGE BROKER SAID THAT A DOWNPAYMENT FOR ALL INVESTMENTS PROPERTIES INCLUDING REFINANCING WOULD BE 35%! AS WELL YOU CANNOT USE A HELOC OR ANY GIFTED FUNDS FOR A DOWN PAYMENT IN AN INVESTMENT PROPERTY.

A: I have not been able to confirm either forecast. All are rumours. We know that OFSI is very much against all HELOCS and is forecasting a possible 18% collapse in prices for 2022. With that having said (by them) ONE of or all of the above scenarios are possible.

NATIONAL – CANADA

GENERAL: We have had a lot of questions and comments on the “high may be in place’ comments. It is clear that momentum is slowing (look at the Fraser Valley board stats) but it is still there.

I expect hat this spring a large number of owners will continue to list(!). Initially many of those listings will be soaked up’ by the demand, but it well may slow into the summer with news reports about listings and a slowing market.

If you are an investor, take a good hard look at your portfolio. Sell your losers (subsidizing rental income) keep the cash flow (it will be harder to come by in the future). As an owner, understand your blessing of low rates – maybe look at your HELOC convert it to a long-term mortgage.

INTEREST RATES CHANGE

The Bank of Canada changed the interest rate by .25% – as expected. For those in a variable rate mortgage and/or a Home Equity Line of Credit, your interest rate will rise accordingly (.25%).

However, as we pointed out last month, not a big deal yet! Your mortgage payment will increase by around $12 per month for every $100,000 borrowed. For example, if your mortgage balance is $400k, the payment may increase by around $48 per month.

If you are in a fixed payment variable rate position, even though the interest rate has changed, your payment will not.

BRITISH COLUMBIA

The ‘BCREA Nowcast’ estimate of provincial economic growth for December 2021 is 5.1 per cent. For comparison, year-over-year growth in the Canadian economy in December was 3.9 per cent. The preliminary estimate for January 2022 is 4.2 per cent. The BCREA Nowcast estimate of average growth in the BC economy in 2021 was 6.3 per cent.The 4.2 per cent estimated growth in January is the second highest starting point in the history of the Nowcast.

So good for Real Estate and Real estate is a key economic driver in British Columbia:

- REALTORS® transacted more than $33.7 billion in real estate in Greater Vancouver in 2020.

- The real estate sector created an estimated $2.1 billion in economic spin-off activity in BC in 2021.

- Real estate created an estimated 14,728 jobs in BC last year.

- In 2020, 30,944 homes changed ownership through the MLS® in Greater Vancouver.

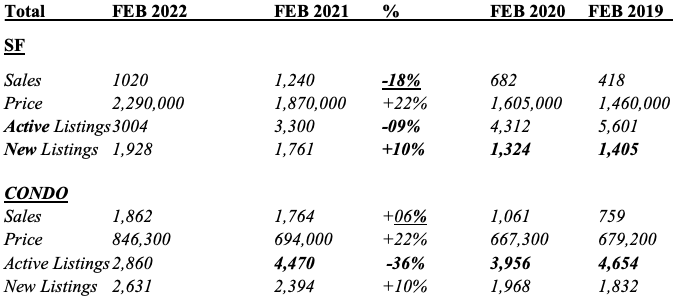

THE NUMBERS

Vancouver

Remember to take the 2020 comparisons with a grain of COVID salt!

The Real Estate Board of Greater Vancouver (REBGV) reports sales of 3,424 in February 2022, an 8 per cent decrease from the 3,727 sales recorded in February 2021. Still, last month’s sales were 27 per cent above the 10-year February sales average.

There were 5,471 new listings for sale in February 2022. This represents an 8 per cent increase compared to the 5,048 homes listed in February 2021 and a 31 per cent increase compared to January 2022 when 4,170 homes were listed.

You will hear that sales doubled over January (they do most years). Normally biggest activity takes place in the March to June period. But nothing is normal anymore.

SUMMARY:

- Vancouver new SF listings are up 10% – sales down 18%

- Prices are still way up +22%

- Vancouver Condo listings are up 10% — sales up 6%

- Condo prices also way up + 22%

Vancouver Major Point: SF sales are down over 2021 but still second best in 10 years, Condo sales have turned up!

Note: New Condo listings higher over January by 10% and way more than December’s 1,060!

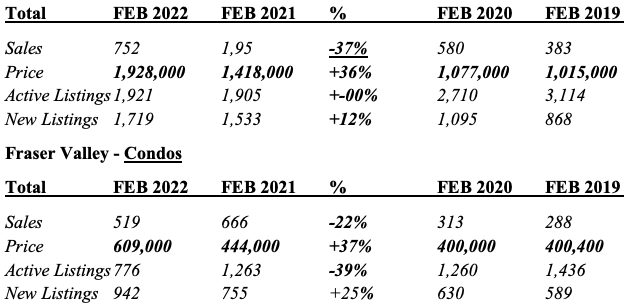

Fraser Valley – SF

The Fraser Valley Real Estate Board counted 3,742 new listings in February, an increase of 75 per cent compared to January, and an increase of 15 per cent compared to February of last year.

The previous highest February for new listings was 3,283 in 2016.

The FVREB processed a total of 1,824 sales in February 2022, a decrease of 35.2 per cent compared to February 2021. Sales remain strong at 18 per cent above the 10-year average.

Fraser Valley Major Point:

SF sales down a whopping 37% – same with Condo sales – down 22%.

BUT:

SF Price up by 36% – Condo prices up 37%

SF new Listings up 12% – Condo new listings up 25%

MAJOR, MAJOR POINT: The market remains very tight. But it is shifting. As we said last month: The HIGH may be in place! New listings are clocking in much higher and sales sharply lower throughout the Valley. Still … sales are still higher than 2020 and 2019.

- Ozzie, Michael Campbell, Michael Levy and Victor Adair and guests are now on podcasts every week: https://omny.fm/shows/money-talks-with-michael-campbell

- If you are in building, selling, marketing, developing, lawyering, etc. list yourself in the free BC real estate directory: www.bcred.ca

- Questions to Ozzie and experts: www.askanexpert.ca

- Set up your own “talk” at www.realestatetalks.com. Ozzie’s 24-year-old bulletin board for you to play in.

- Want to see all Ozzie blogs and all Ozzie podcasts? Go here: www.ozbuzz.ca

- Who the heck is Ozzie? Go to www.ozziejurock.com

- Ozzie on YouTube? www.youtube.com/jurockvideo

!!! Think about this !!!

Look after your body…

If you do not…

Where are you going to live?

I eat for vitality, longevity, and health

I work an exercise program designed

For energy, stamina, and strength

I can and will do my program

I will grow into my future best

GROW INTO YOUR FUTURE BEST AND LIVE YOUR LIFE LARGE

DISCLAIMER

Please note that any response to any email or any invitation to any meeting is accepted on the understanding that “Jurock Real Estate Insider (JREI)”, “Oz Buzz (OB)”, “JCIR (JC)” as the case may be, are not responsible for any result or results of any action or actions taken in reliance upon any information contained in this posting or meeting, nor for any errors contained therein or presented thereat or omissions in relation thereto.

It is further understood that the said OB or JREI, or JCIR as the case may be, do not, pursuant to this posting, purport to render legal, accounting, tax, financial, planning, or other professional advice. The said OB and JREI and JCIR may or may not own properties discussed at meetings or receive or not receive referral fees at any meeting you may attend as a result of this posting or invitation. The said OB and JREI and JCIR, as the case may be, hereby disclaim all and any, liability to any person, whether a purchaser of any offering, a reader of any offering, or, otherwise, arising in respect of this postings and of the consequences of anything done or purported to be done by any such person in reliance, whether whole or partial, upon the whole or any part of the contents of these postings. If you respond to any posting OB or JREI and JCIR or attend any meeting from and by said companies, we fully expect that you get independent legal/tax/investment/mortgage advice as the case may be.

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

Moneytalks Podcast

Ozzie, Michael Campbell, Michael Levy and Victor Adair and guests are now on podcasts every week: https://omny.fm/shows/money-talks-with-michael-campbell

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment