March 16, 2024

How come you never see a headline like: ‘Psychic Wins Lottery’? — Jay Leno

!!! A BIG THANK YOU!!!

THANK YOU, THANK YOU! The SPECIAL OLYMPICS MONEYTALKS team thanks our illustrious leader Michael Campbell, brave hearted and injured TROOPER Gordon Campbell, past MP John Weston but MOST OF ALL the plungers or donors who took action!

THANK YOU…!!!! YOU!!!…WHO DONATED!

WITHOUT YOU WE WOULD NOT HAVE been able to raise over $54,000 for this OH SO worthy cause.

If you missed it … well … here watch it and weep…

Listen to Ozzie’s Podcast on Apple cast, Amazon video, Spotify and Ozcast here:

https://ozbuzz.ca/category/podcasts/

(NOTE: all of these above available as videos on Youtube.com/jurockvideo)

AGENDA

- THE MICHAEL CAMPBELL SPECIAL OLYMPICS PLUNGE TEAM

- 20% FLIPPING TAX

- THE SUMMER OF DISCONTENT AHEAD

- SOME WORRIES FOR THE WORRIED

- INFLATION IS UP AGAIN. NEXT WEEK WE’LL KNOW WHAT THE FED PLANS (WATCH OZZIE VIDEO THURSDAY)

- RENEWING INTEREST RATES? THINK HARD

- THE NUMBERS, THE NUMBERS

- EV DEBATE AND SOLAR…

AGENDA

- THE MICHAEL CAMPBELL SPECIAL OLYMPICS PLUNGE TEAM

- 20% FLIPPING TAX

- THE SUMMER OF DISCONTENT AHEAD

- SOME WORRIES FOR THE WORRIED

- INFLATION IS UP AGAIN. NEXT WEEK WE’LL KNOW WHAT THE FED PLANS (WATCH OZZIE VIDEO THURSDAY)

- RENEWING INTEREST RATES? THINK HARD

- THE NUMBERS, THE NUMBERS

- EV DEBATE AND SOLAR…

COMMENT!

What an outpouring of support. First Nations managing all crown land together with our government raised some eyebrows (to the back of the head). Too many of you for me to answer individually. First though I did use the word Native instead of First Nations. And yes, I should have known better: First Nations is correct.

The government backtracked. THANKS TO YOU AND WROTE/CALLED THEIR REPS. They listened and reversed … for now. But the war has not been won – just one battle. The Government said as much … it will regroup and re-assess (not cancel the objective!). Revisit the extensive reason on why in our opinion there should be a public debate first in Ozbuzz 92.

NEW REGULATIONS THAT HAVE BEEN PASSED AND WILL BE IMPLEMENTED

Under no circumstances should you take me for a ‘government is all bad’ kind of guy. I am sure that all governments (yes, also the BC government) always have the best of intentions.

BUT THE ROAD TO HELL IS PAVED WITH GOOD INTENTIONS. This summer we will see the intentions at play … call it: “The summer of construction and municipal discontent!” The new legislation by its nature will see a heck of a lot more people in your neighbourhood … like it or not. June 30 is implementation day … for allowing the vast majority of property owners to increase building density on their plots. What is happening?

Well, every municipality with over 5,000 people MUST allow four-plexes (plus) up to three stories tall on SF zoned lots (larger than 3,014 square feet). For larger lots or those within 400 meters of a frequent transit network, six units can be built.

HOWEVER, THE DEVIL REMAINS TO BE IN THE DETAILS! What are they? Size of buildings, rentals allowed, strata allowed. Who pays for infrastructure, more schools, hospitals transit, etc., etc. What assessments will YOUR residential house pay if your neighbour now has a commercial property?

Major Point: If you are a developer, you must have your head examined if you want to buy a lot, a plot, or an acre if you don’t know what you can put on it? With the speed of light changes the BC leaders changed STRs, killed Airbnb and the tourist sector in BC, what speed of a slew of new regulations will they impose on the “bad” developer?

But THERE ARE SOME THAT FIGHT BACK! PRINCE GEORGE!

Prince George city council pushes back against short-term rental rules.

B.C. law that takes effect May 1st would limit short-term rentals to host’s primary residence and either a secondary suite or accessory dwelling. Municipalities are now forced to pass laws to stop STR and attack Airbnb at the same time yet most of them urgently need the visitors and to fight the enormous hotel room charges – now rising further. I mean why were STR so popular for the visitors? Have you taken a look at the cost of a hotel room in BC? You haven’t seen anything yet. $800 a night will be the norm this season!

OH AND IN BC WE NOW HAVE THE FLIPPING TAX

By wanting to charge 20% tax on property owners selling within a year of purchase starting Jan. 1, 2025. We had soooo many questions. We do not know all the answers but have been in touch with lawyers, because the devil is always in the details. When we know more, we will update you soon … or do a video.

Major, Major Points to peruse:

- Government says we need more housing.

- In order to have more housing we need developers/builders.

- In order for developers to build they need bank loans (you think they have $70-90 million laying around?).

- In order for the banks (3 or more) to give construction loans they want 70% or so units PRE-SOLD or no loan! No loan, no building!

- Investors step up to the plate and invest in the hope of a return on their investment.

- We need the investor. Without the investor the building will NOT be built.

Ok, if you understand that – what does an investor see now?

I will buy a $1 million presale condominium in a high rise – wait for 7 years. Need 20% or $200,000 down. Hope prices will go up by $100,000.

OR

Put $200,000 down in the bank at 6% for 7 years and have close to $90,000 increase of capital with NO risk.

Or I look at what happens to my projected $100,000 profit in my presale unit after 7 years. Taking a chance on markets? But let’s look at that … the federal government takes its new speculation tax. It taxes gains at 100% if you sell it in the 8th year at your tax rate – say 40%?!

BC adds – yes adds – a new flip tax of 20% … add 5% GST – that is 65% for taxes… PLUS commissions, legal fees, etc.

WHY ON EARTH not just put my money in the bank?

Note: “I don’t expect this tax to make a great deal of difference either way,” said Tom Davidoff, director for UBC’s Centre for Urban Economics and Real Estate. He also highlighted a residential property flipping rule the federal government instituted in 2023 that ensures profits from the disposition of flipped property are taxed as business income hasn’t helped bring down the cost of housing.

Ok, ok – are we too hard on Politicians? Well? Lyndon Johnson commented on the News Media: “If one morning I walked on top of the water across the Potomac River, the headline that afternoon would read: ‘President Can’t Swim.'”

QUESTIONS, QUESTIONS

Q: Did not like your negative comments on EVs and solar. People like you stop progress. (rest deleted)

A: My admittedly offhand comments relating to specific problems with solar Panels and billions lost by companies abandoning projects when Government subsidies ran out.

Fact is that some goals by our various world governments are simply not feasible.

Government plans need 11,000 Megawatts of new electricity by 2035.

To be fully electrified by 2035, we would need:

10 new site C size dams in BC (Fraser Institute). Huh?

Site C took 10 years of planning, infighting and almost cancellation. Then add 10 years of construction and then double the cost planned. It’s now likely $16 billion!

Simply not feasible to have the electric power available by these kinds of deadlines.

In the meantime more and more high and higher taxes. The Carbon tax is a joke…etc., etc.

For EV cars? We have had the winter of EV owners discontent. EVs don’t start, have no heat (no air con in the summer), take hours longer to charge, batteries show 100 miles left – die after half the distance. Never mind outright replacement of batteries. Can you say $2,000 or $5,000?

I also didn’t say it was not going to happen. I just compared the EV madness to being a pioneer. (Those that got killed by the First Nations). I want to be a settler. My EV will work, will charge as promised, will not cost the proverbial arm, and leg and lose 60% of value in 3 years.

Need I say more…You are a pioneer. Good on you. I salute you, but I will not be as brave as you and buy one.

Of course I didn’t talk about the poor decisions of car makers … or why you should not be a pioneer. The worst decisions car makers and governments ever made. They are drinking their own milk … but it’s sour!

BTW: Hertz lost its CEO and is trying to get rid of 30,000 EVs. As far as other comments go…re-read what I wrote last year. How can you possibly be offended by it?

Q: INFLATION (lots of questions)

A: Just revisit Ozbuzz 92 and previous. Hard assets are rising. CPI and PPI are higher than forecast. Next week US FED will indicate whether or when or both they will raise/cut/stay the same on rates.

INTEREST RATES

Fixed mortgages did decline to the point where some three- or five-year terms are carrying rates of less than five per cent. Some homebuyers secured an insured five-year mortgage rate as low as 4.79 per cent, according to Ratehub’s aggregated list of rates on offer. However … as we warned last month – rates may rise and currently are following the bond rates – as in higher! Again – get pre-approved!

$134 billion of mortgage are due to be renewed. If you are in that camp you must analyze your options. Will you go long around 4.79% (changing as we speak) or go variable, hoping your payments drop if the prime rate drops. If rates come down … your choice will likely be a variable rate. Options?

You must choose between an adjustable-rate mortgage (ARM). Principal stays the same, but overall payment adjusts with prime rate.

Or

Choose a variable (VRM) rate where your payment stays the same but the split between interest and principal changes as the prime rate changes.

Major Point: Before you sign, find out what you want and see your preferred mortgage broker and look at ALL the OPTIONS. Even if you have the mortgage, ask what possible payout penalties you get when you want to lock in later. Yes, Canada’s banks are assessing 30-year amortization with CMHC, several offering it now. There is even one at 40 years! Much higher cost.

HERE ARE SOME WORRIES FOR THE WORRIED

Buffet:

Why did Buffet sell all his housing stocks – after making 36% in 7 months?

Why is Buffet sitting on 136 billion in cash?

Wars

We said last month: If Middle East conflicts escalate – we could have another supply shock and troubled shipping lanes. Can you spell $150 dollar oil? Risen since then.

Recession?

In Ontario troubled builders and developers are threatening to bankrupt Tarion. Tarion Faces a historic $90 Million claims as Ontario Builders Default amid Economic Strains (story below). The surge in claims stems from builders abandoning projects compounded by a maelstrom of rising interest rates, escalating construction costs, and persistent labor shortages.

Stocks and Bonds

The eclectic Victor Adair raises a warning finger:

“With interest rates rising every day this week, and with the S&P and the NAZ closing lower for two consecutive weeks (for the first time since October) is the stock market (and gold and Bitcoin and the currency market) starting to worry about sustained high inflation and interest rates? It looks that way, and with ‘everybody in the pool’ the stage is set for a reversal!”

victor@victoradair.ca (sign up – still free ace newsletter anything stocks/bonds)

THE NUMBERS, THE NUMBERS

Snapshots:

TORONTO sales up 17% (leap year 13%)

- Price up .2% over 2023

- SF $1,650,000 BUT high was March 2022 at $1,920,000

- New listings up 33%

- Active listings up 15%

CALGARY

- Sales up 23%

- Listings under $500,000 down 40%

- Apartment prices up 19%

- SF prices up 13%

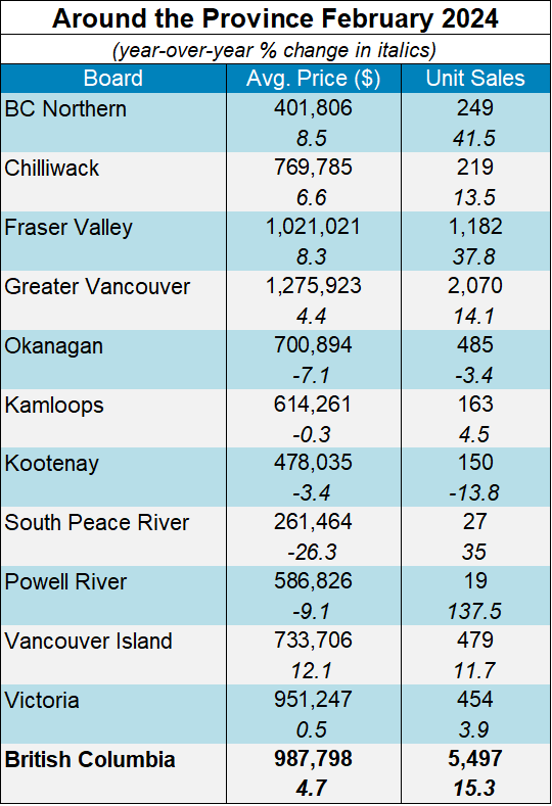

BRITISH COLUMBIA NEW NUMBERS

The BC housing market is in a period of relative calm entering the spring,” said BCREA Chief Economist Brendon Ogmundson. “While activity is picking up, home sales remain below normal, and home prices have been essentially flat since last summer.”

Active listings are up 20.3 per cent over last year as a result of slower sales but last year was the slowest pace of new listing activity since 2005.

Source: BCREA

VANCOUVER

Listings rose 31 per cent year-over-year in February but still 23.3 per cent below the 10-year seasonal average (2,699). The total number of properties currently listed is 9,634, a 16.3 per cent increase compared to February 2023 (8,283). This is three per cent above the 10-year seasonal average (9,352).

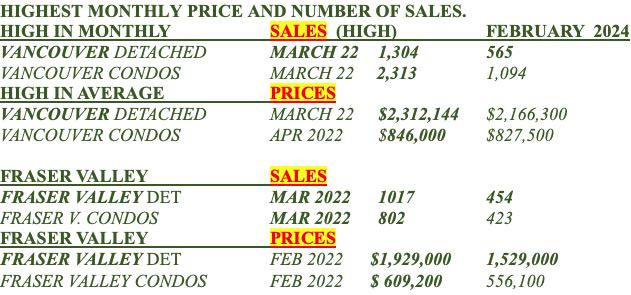

SNAPSHOT FEBRUARY 2024 VANCOUVER AND FRASER VALLEY

We told you last year that, as we compare ourselves in 2024 to the same months in 2023, we will look great! The market collapsed in 2022/2023 – now it has recovered? Well against 2023, yes! BUT NOT AGAINST 2022, 2021 AND 2020 and way behind the highs achieved.

Vancouver and Fraser Valley

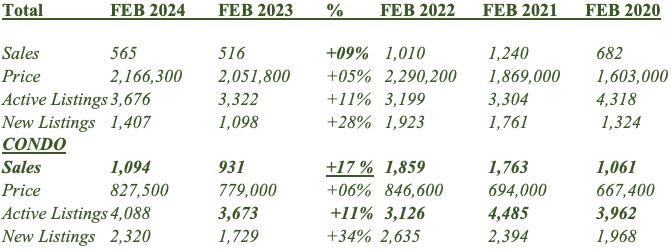

While SF sales are a tad better, they are still 23% below the 10-year average for FEBRUARY. Indeed, in FEBRUARY 2024 sales were better at 565 SF homes. But, in 2022 we sold 1,010, in 2021 we sold 1,240 and 2020 we sold 682! We are WAY behind, plus Vancouver SF and condominium new listings are up 28% and 34%, respectively.

Here is a 5-year FEBRUARY 2024 over FEBRUARY 2023/2022/2021/2020 comparison.

VANCOUVER – Single Family

Major Point: Vancouver condo price better than 2023 but below 2022!

Get your professional realtor give you the numbers for the sub-area that YOU are interested in.

FRASER VALLEY – Single Family

Major Point: Fraser Valley – SF Sales are still up by 40%. Not up as much as January over January (+ 62%). But we are still well below sales of 2022 AND still 30% lower than 2021. New listings are up 36% in condos; up 56% in SF homes.

MAJOR, MAJOR POINT: We hear of (well-priced) multiple offers. We hear of full open houses. But also, some houses have been sitting there. The thought of possibly lower rates is a motivator. The story in February was stronger in sales, but not strong. Higher in listings. As last month, please note that in our view interest rates will not be lower until June – if then. US inflation rates (also Canada) are much higher. Employment reports are soaring. We will know more after March 21.

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

Moneytalks Podcast

Ozzie, Michael Campbell, Michael Levy and Victor Adair and guests are now on podcasts every week: https://omny.fm/shows/money-talks-with-michael-campbell (See Victor Adair’s Trading Desk notes! https://victoradair.ca/)

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Oz Buzz Podcast

Disclaimer

Product Special

RECENT POSTS

Oz Buzz #97: All New Multiplex Changes Are Now Law

July 14, 2024 “The past is a great place, and I don’t want to erase it or regret it, but I don’t want

MORE URGENT! The new Multiplex! Where – how exactly? What rules? Get FREE STUDY – DEFINITIONS – CHECKLIST

Expert Guest: Bill Laidler, President of Laidler Academy and Laidler Development. Laidler is a trusted Real Estate Agent turned Multi-Family Developer in

Leave A Comment