“More data means more information, but it also means more false information.”

December 7, 2019

Today’s Issue:

- HOT PROPERTIES Indian Arm 1.65 acres, new price $165,000

- QUESTIONS, QUESTIONS

- HOAXES

- VANCOUVER NUMBERS – ROCK!

- SKI RESORTS – WHAT NOT TO BUY

- THE POWER OF ‘WHY’.

- PREDICTIONS – OUTLANDISH OR FACT

- MORE OXYMORONS

- OZZIE OPINES ON INFLATION

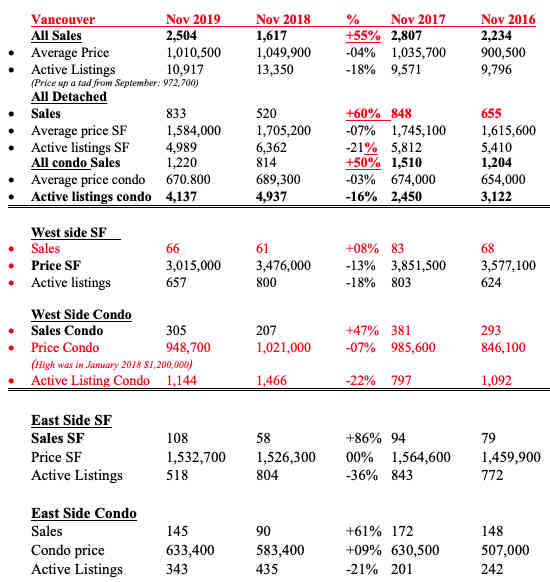

VANCOUVER NUMBERS

It looks like all over Canada, we shook off any bad news and bought real estate in November. We held that July SGF numbers pre-told of a bottom, and that is exactly what happened.

Montreal sales up 16%, listings down 22%, prices 6% higher.

Toronto sales up 14%, listings down, prices 6% higher.

Vancouver sales up 55%, listings down 18%, prices still a bit lower -4%.

But if you dig into the Vancouver numbers you see an amazing picture: Prices for East side condos are now $127,000 higher than in 2016 and up $3,000 over previous high of 2017 and sales are 86% higher! West side condo sales are up 47%, but prices still lower by 7%. July, August, September, October sales were positively steaming! November … a massive follow through. Clearly though all sub-markets perform their own way, before you buy – get the quality realtor and then study.

(We put in the last 4 years of numbers, since these 4 years represent the massive swings in the market and give you a clearer picture of what is happening.)

Major Point: Eye opener this month:

East Side SF sales up 86%, condo sales up 61%.

East Side condo price up 9% (higher than any past November reported!).

As we said last month: The overall SF market has strengthened since mid June. November total sales were up a whopping 55%. Listings are down by 18%. Condo sales overall are higher by a rocking 50% while still lower than 2017, up over 2016. But East side condos performed higher than in 2017! We said that “…we are gearing up to surpass 2017…once we do…back to normal in October?” Yes, we did!

We asked in August: Listings – including condos – are lower – bottom in? The answer? Yes!

Still, again it is a mad world, negative interest rates, slowing global growth, trade wars and great geopolitical risks.

Money is on the move worldwide looking for safety … and you have not seen anything yet. The bet? Higher prices ahead again.

Best deals? Buy new condos, make lowball offers…

WORRIED ABOUT FRIDAY THE 13TH?

Go see the very big Meteor Shower expected this night. One of the biggest in years.

HOAXES

By now you all read/heard about the 823-year calendar occurrence. 5 Saturdays, Sundays, Fridays which happens this December. Actually, the first 3 weekdays of any 31-day month are repeated 5 times in that month. So, any month that has 31 days and begins on a Friday will have 5 Fridays, 5 Saturdays, and 5 Sundays. Similarly, any 31-day month that begins on a Tuesday, will have 5 Tuesdays, 5 Wednesdays, and 5 Thursdays. So, HOAX! Why mention it? Well, I get peppered with hoaxes on a regular basis (must pass this on or you are not my friend, I know if you don’t read this …on and on with nonsense…all designed to get you to blast your database). All you do is clog up the system and make providers look like they have more traffic. I have 7,000 friends on Facebook, 6,600 on Twitter, 5500 on LinkedIn 2,900 on realestatetalks.com and run 7 websites. If I passed on every one of these hoaxes to everyone else, I really would be a fool.

Ok, while I am at it: I was recently accused (in a friendly way), that I did not contribute to the birthday charity giving – only $100 or so … I surely could afford it. I get 8-12 a week – enough said. (Of course, if you’re a personal friend, send me an email, I support all sorts of causes.)

2019 SKI RESORTS

In the last few years, we raised some eyebrows and some comments about our ski town picks. (Raised eyebrows were found elsewhere too.) Most opinions about ski resorts come from skiers – not investors. Those opinions differ. Do they ever! Where we had talked about fine snow, we were told snow elsewhere was better and where we talked about ‘ratings by a world news magazine’ we were sent other magazines that rated yet another resort better. There is no doubt that in BC we are blessed with a multitude of absolutely great ski resorts. No doubt then, everybody is right … we got great skiing. In this issue, while we talk about the skiing, we primarily are concerned with – hopefully – to find the resort with the snow PLUS a great deal.

Ozbuzz takes the view that ALL real estate is cyclical (read my book “Forget about location, location”) and if bought at the right time (as in prices are really low) you will make money. Thus, had you listened and invested in our top pick since 2014 – Whistler – you would have had fine skiing and made a lot of money.

So, Whistler, Sun Peaks, Fernie, Kimberley, Silver Star and Big White will all be analyzed from the “will I make money while I ski?” point of view.

Major Point: Remember, you always want to have a 2-legged resort…skiing plus golf (for summer rentals). You must understand the difference between types of real estate. Hotels? NO! Quarter share? NO! Timeshare? NO! Phase 1 (Whistler)? YES! Phase 2? Only if you get a smashing deal.

QUESTIONS, QUESTIONS

Q: Not sure how you can be positive abut real estate going higher. The world is in trouble, people are striking everywhere…can’t end well. Your thoughts?

A: The world has been in trouble forever. The reason may be clear: The spread between the have and the have-nots is ever widening. Government is the evil, no one can be trusted. I would agree that we are out of balance. Governments seem to live in their own world. As for strikes: I love seeing them, it proves my point that we live in the world’s most unreported inflation of all times. Inflation in hard assets that is. (Commodities can be in deflation at the same time – that is new!). People simply can’t make ends meet without pay increases. Governments say inflation is 2%, yet food is up 17% and rising, rents are up 200 percent in 4 years, etc. etc. So, wage earners NEED to fight. But, totally separate from that is the creation of money. Milton Freedman said: “Inflation is primarily a monetary formula”. I have quoted him for over 20 years. Create more money than we earn, hard assets go higher. And we create more money than ever in history. That excess money settles in hard assets – my bet, is back into real estate. (unless the whole thing collapses…and that has been predicted also for 50 years).

Q: I totally disagree about your view on Tesla. No way Volvo and BMW will beat Elon! I just bought their fantastic new truck.

A: I am not a stock market analyst. But, from the start Tesla lost 50% of value only to recover this year. But that was not my point. Tesla pretty well had the ‘electric field’ to itself…now with new entries…I leave it to you to look at the potential for it.

Q: Loved your TED TALK recommendation. Great videos! Is that where you get your world view?

A: Huh? I am a legend in my own mind.

Q: Just received your “Grow into your best self “card set. Absolutely loved it! I just bought another 5!

A: You had me at ‘bought’. At 5, there now is love!

STRANGE WORDS & OXYMORONS

- I received a lot of oxymorons … ha-ha. Thanks!

- The best: A verbal contract isn’t worth the paper it’s written on.

- Good also: Include me out. Anyone who goes to a psychiatrist ought to have his head examined. A just war. A fine mess. Gentlemen, I want you to know that I am not always right, but I am never wrong.

HOT PROPERTIES

1. 4.5 ACRE PARCELS OF OCEANFRONT … WITH A COMMUNAL DOCK at Chatham Channel $76,500. Salmon FISHING PARADISE on Vancouver Island … Port McNeill on Northern Vancouver Island and 55 miles NW of Campbell River.

2. SKEENA RIVER 149-acre water access property has 2,700 ft of oceanfront in the mouth of the Skeena River. Small pond, timber (volume & quality to be confirmed by buyer) & a log cabin circa 1987. Log cabin condition is uncertain. Property is believed to be a former cannery site,149 acres – $395,000.

3. Historic Indian Arm at Vancouver’s back door. West facing recreational lot ready for dock and cabin re-build. 1.65 ACRES (LEASE) NEW PRICE $165,000.

4. North Surrey: 2 bed upper-townhome with renos + low strata fees – $299,000.

5. Richmond, Prices slashed by $200,000. Prime location in the Steveston/London catchment area. 3 bed, 3 bath, 1330 sq. Ft, built in 2019 – $699,000.

6. Exclusive Presale. Brand new house in core of Edmonton. $500,000. Built to luxury spec, with legal basement suite.

BOOK OF THE WEEK

Ted Talk Guru explains his talk about the “why”. What separates leaders from the rest? It’s that these leaders, products, and companies start with WHY. In his book Start With Why, Simon Sinek explains why this approach works, and how every aspiring leader can incorporate it. As Simon mentions throughout his book: “People don’t buy WHAT you do; they buy WHY you do it.”

Ted Talk Guru explains his talk about the “why”. What separates leaders from the rest? It’s that these leaders, products, and companies start with WHY. In his book Start With Why, Simon Sinek explains why this approach works, and how every aspiring leader can incorporate it. As Simon mentions throughout his book: “People don’t buy WHAT you do; they buy WHY you do it.”

OZZIE SONG OF THE WEEK

Loved your “Fine Frenzy” song. Checked her out … she is great. How come I don’t know her?

A: Dz.dz.

HOLIDAY SPECIAL

Listen to Ozzie Jurock’s 25 Money Making Principles in the comfort of your home or car, as well as his two books, ‘Real Estate Action 2.0’ & ‘What, Where, When & How to buy Real Estate in Canada’ – now available on USB!

Choose from one of our three great holiday specials

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.com at 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

LIVE LIFE LARGE

Long term constructive goals are

a by-product of a strong commitment

to constructive values.

MY values are the principles

That guide me.

I will grow into my future best!

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment