March 2, 2020

“I can guarantee right now that there’s a 14-year-old Aboriginal kid out there taking his first drink of alcohol or sucking on his first joint,” Ross said in a Facebook video. “He’s on his way to prison. That’s his road map. But I guarantee you those activists who are going to stop development in your territory do not care about that kid. They don’t care if that kid commits suicide.

“But if you save that kid, show that kid there’s a better future out there, get him into a trade, get him into a course, show him a work site, show him there’s a better future in terms of getting a house, a job, going on vacation, buying a truck, then you’ve done your job.”

From Mike Smyth article, The Province

- VANCOUVER FEBRUARY NUMBERS

- HOT PROPERTIES – ALBERTA 2,101 ACRES FOR $893,800.00

- QUESTIONS, QUESTIONS

- OZZIE’S BLACK SWANS

- CYCLES (LAST IN THE PRINCIPLES SERIES)

- CORONA VIRUS – IMPACT ON MARKET

- STRATA INSURANCE DEBACLE

- STOCKS CRASH – IMPACT ON REAL ESTATE?

- STRESS TEST RULE CHANGE

- SPOTLIGHT ON VICTORIA

- WORLD OUTLOOK RECOMMENDATIONS

- SURREY POPULATION/VANCOUVER ISLAND GROWTH BODES WELL FOR A BRIGHT FUTURE

OZZIE TALKS/ATTENDS

Feb. 25: Victoria – Ozzie speaks at Real Estate Group

March 9: Vancouver – Ozzie chairs Real Estate Action Group – call 604-717-6050

March 10: Vancouver – German Serendipity Group – North Vancouver

March 11: Vancouver – Attends Célébration du centenaire de l’État du Grand Liban 1920-2020

March 17: Vancouver – Ozzie teaches clarity and Quantum Leap – For tickets call 604-683-1111 (limited availability)

March 19: Vancouver – Gastown L’Abattoir – FRY client mixer

March 7, 14, 21 and 28: Canada – CKNW, Michael Campbell’s Moneytalks Radio show 8:30 AM – 10 AM, cknw.com

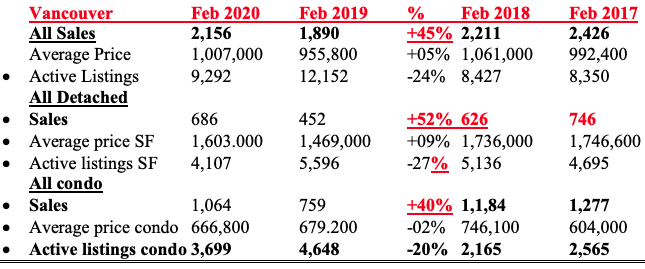

THE NUMBERS, THE NUMBERS – VANCOUVER

Listings are across the board … sales continue to be up substantially and surprise, surprise – prices are up as well. Particularly in the single-family home sector.

Major Point: I report sales for last 4 years – look at them…prices are up across the board by 5%. Again: Not just a flash in the pan. Sales are up, listings are down. We said last month: The next 2 months (Feb/ March) bear close watching. February did not disappoint. March? All bets are off, because of Black Swans (see above).

QUESTIONS, QUESTIONS

Q: I read your piece on strata insurance. I don’t see how an increase in insurance can sink the condo market.

A: I didn’t say it would sink the market, I said it would seriously affect the market. When premiums quadruple or when there is no insurance – it seriously affects the owners. When you cannot get insurance on your new purchase, the bank will not give you a mortgage. That will seriously affect buyers. In any case, as a buyer always check renewal date of your strata policy. If it’s renewing this year, you will see a large jump of current rates. Also ask: Have they had leaking pipes? Water ingress? Large insurance claims in the last three years? It’s not perfect but it may be necessary.

Major Point 1: Go to the BCREA Online Blog for clarification and an actual clause you can insert in your contract.

Major Point 2: We now hear boat insurance is extremely hard to get as well. It looks like the whole insurance/re-insurance market is in serious reversal. Please pay attention to all your investment properties, your home, and yes – your boat.

Q: The whole world is writing about the coronavirus; will it affect the Vancouver real estate market?

A: The virus demonstrates two things:

- There are still Black Swans circling overhead that are unpredictable in their scope and their impact.

- The virus demonstrates the interconnectivity between most countries in the world. We sell a car in Vancouver, parts of which were made in Toronto, Milwaukee, China and Germany.

Thousands of people touched the products and services that are made worldwide and thus a virus takes on a different kind of dimension. It can grow faster and more worldwide than ever before. We are now at 76,000 people infected. Will it affect Vancouver? To the extent that we are a gateway city, there will be fewer tourists to the city, fewer tourists to Whistler, fewer tourists to Alaska.

In fact, to book a cruise now would probably be the lowest price cruise you’ve ever enjoyed. So, the virus affects everyone and everything – yes Vancouver too!

Major Point: The virus has dropped bond yields by around .3 per cent and thus fixed rates have fallen .3 per cent. If the virus spreads, the one positive will be lower rates. Review all your mortgage renewal dates, we may well see the all time low 5-year term coming in the next five weeks.

Q: How will the US election affect interest rates?

A: We have recommended for years to have your mortgage term come due in a US election year. For some magic reason, US Presidents do not raise rates in an election year. In addition, this will be the hardest, most brutal election in history. No one will want higher rates. Also – for what it’s worth – no matter who wins, the opposition will fight tooth and nail even after he/she is elected to bring them down.

STOCK MARKET CRASH

This week’s serious 14% crash in the stock markets around the world will need you to seriously evaluate your real estate portfolio too. The stock market collapse has sucked cash out of the pockets of investors like a vacuum cleaner, which means that the purchase of recreational properties and investment properties will be under review – with likely postponement. Individuals will no longer feel the “wealth effect” of their stock portfolios and will be concerned about adding any risks – including real estate.

In addition, as we said above, fewer people will be travelling to ski resorts and elsewhere as dozens of events are being cancelled due to the virus.

Major Point: If a seller, sharpen your pencil, if a buyer, make offers.

STRESS TEST RULE CHANGES

The stress test is only for insured mortgages, but there is talk about it extending to conventional mortgages.

The mortgage qualifying rate will be the median of the big banks’ median insured 5yr rate plus 2% now. As of Apr 6, this rate goes to 4.89% from 5.19%.

The .3% rate drop increases borrowing power by about 3%. So, for example, someone who qualified for $500,000 would now qualify for about $515,000.

This follows a recent review by federal financial agencies which concluded that the minimum qualifying rate should be more dynamic to better reflect the evolution of market.

SPOTLIGHT ON VICTORIA

Victoria. CMHC claims that it is the only overheated market. Not sure about that, but things are a’ hopping in Victoria:

- Victoria new stats, eye popping, population increase: 5,000 new people a year. In fact, population is up 6.8% in 5 years.

- 22 of British Columbia’s top employers are located on Vancouver Island.

- Victoria ranked 4th most expensive city for renters in Canada. This is reflected in their vacancy rate of 1.5%! Rents are up about 20% in 3 years.

- Millennial Hot spot No. 2? Victoria! (No. 8? Saanich. No. 10? Vancouver)

- BOM ranks Victoria No. 4 strongest job market

- HARRY and MEGHAN have helped shine the International Spotlight on Greater Victoria.

- MacLean’s ranked the ‘wealthiest communities in Canada’, 2 out of top 10 are in Greater Victoria

Major Point: Of course, 70 percent of Canadians want to retire here too. Good place to live and buy.

OZZIE’S BLACK SWANS – FROM OUTLOOK CONFERENCE SPEECH FEB. 5, 2020

What could happen:

- The coronavirus spreads into a pandemic, which means less travel and less interest in small towns and recreational real estate, etc. It will have a cocooning effect which will keep people in SUSPENSION – SCARED TO ACT – slowing all sales.

- The strata insurance debacle is growing. If no solutions led by Government, it could stall the condo market.

- I said that if Trump loses and Elizabeth Warren wins, this would seriously(!) affect Canada. While it is less likely she will win, it is now possible that Bernie Sanders will win. Same result – head for the hills.

- The other ‘Black Swans’ had to do with edible pot. Medical marijuana infused coke and a whole plethora of drugs into regular food items. Unbelievable consequences ahead.

- There is a huge danger in ETFs if there is a liquidity crunch.

Major Point: As always, I pointed out 5 ‘Black Swans’ (a black swan is a sudden, unexpected, unpredictable event). This week, three of my black swans happened at the same time.

SURREY POPULATION GROWTH

The population of all of B.C. continues to grow, but it’s the city of Surrey leading the way. B.C.’s population rose by more than 70,000 people last year, hitting 5,071,336 as of July 1, 2019 according to B.C. Statistics’ 2019 population estimates. This is an increase of 1.7 per cent over 2018. Note: Surrey’s growth was at 2.9 per cent, which was the largest hike in the number of residents year over year of any single B.C. community at 16,382. It’s not growing at 1,000 a month but it’s more like 1,400 a month.

Surrey’s improvements in infrastructure include the recently announced SkyTrain extension, the Pattullo Bridge repairs and the creation of a new city police department. Surrey has three new ice rinks, a new community centre in Clayton and more than a dozen new schools.

VANCOUVER ISLAND POPULATION GROWTH

The Vancouver Island communities of Langford, Duncan and Colwood were the three fastest-growing large municipalities from 2018 to 2019.

Langford grew 5.2 per cent between July 1, 2018 to July 1, 2019, or almost 2,100 people, Duncan by 3.7 per cent or 193 people, and Colwood by three per cent or 546 people, according to provincial agency’s population estimates.

CRAZY INTEREST RATES

In 2019, 49 central banks cut interest rates 71 times. Not the Bank of Canada. But after last week’s stock market debacle? Expect a concerted effort by banks to lower rates – including Canada, maybe even this week.

The outcome? Uncertain, there is a limit to what central banks can do (as Europe shows: Negative interest rates don’t work).

What is clear however is, that with the long bond rates falling like a stone, long-term interest rates will follow. Good thing for us investors.

Major Point: Look at ALL your holdings with the view to refinance and go long into – what surely will be the all time low in interest rates – for a while.

NEXT MONTH: WHY RENT CONTROL CREATES THE HIGHEST RENT CITIES IN THE WORLD

CYCLES – Continued from Ozbuzz 39

Macro:

In OzBuzz 39 we covered the question on inflation or deflation. In OzBuzz 40 we tackled “timing”, In OzBuzz 41 we covered the trend…today…CYCLES!

THAT WAS THE UP CYCLE

Then developers worried about losing money start selling at lower prices and a race to the bottom (often) occurs. Building incentives, free furniture, free parking spots … you name it … still buyers hold back. The stories are negative and even people with money stay out. Developers stop building, some go broke. A few years pass … then there is a piece of land … that is the down cycle.

Major Point: We entered one in 2015 … we continue to see oversupply. Yet, we also think that some of the new condos may represent the best buying opportunities (from a stressed developer in tough areas or high-end condos aiming at rich foreigners). Particularly in Calgary and Edmonton our Black Swan Oil changed the playing field and dramatically so. I predicted many times in the past that we would see ‘the market’ be affected by this or that event even where I told people that needed to sell to do it ‘now’. Or to get 30% into cash or whatever. That had the effect that dozens of people accused me of having turned negative and saw me in the ‘collapse camp’. Nothing could be further from the truth. Because of my views of long-term inflation, I firmly believe that all hard asset prices will be higher in 5-10 years. But within the long-term view, we have cycles so that does not stop me from also looking at 2016 darkly for some Canadian and US markets. (But not as brightly as last year.)

Major Point: Of course, it is just as important to realize that real estate values – unlike other hard asset classes – are primarily local in nature. That is why the “numbers”, the demand and supply statistics are important. Affordability also plays a role (although in big cities it does not matter, in small cities it is vital). Interest rates also need watching and finally job creation/inward migration are vital to assess as well – locally. (Values grow where people go.)

HOT PROPERTIES

- 2,101 ACRES!!! FOR … PRICE: $893,800.00

For the price of a Vancouver (SMALL) condo buy 2,101 acres! 60 km outside of the city of Calgary. Build a get-away cabin if you wish. Great location for hunting, fishing with 250 (+/-) acres of deeded land in 2 parcels in the MD of Bighorn just north of Ghost Lake, along with 1851 (+/-) acres of government lease land.

Parcel B includes a 90-acre parcel, bounded on the south side by the Stoney 142, 143, 144 Reserve, with a small lake and mixed forest. NO conservation easement.

BOOK OF THE WEEK

Sooo many diets. All work and all fail. I took on the intermittent fasting idea and…it works for me. No counting calories, meat only, vegan etc., etc. but a simple change: When to eat!

Sooo many diets. All work and all fail. I took on the intermittent fasting idea and…it works for me. No counting calories, meat only, vegan etc., etc. but a simple change: When to eat!

In this highly readable and provocative book, Dr. Jason Fung sets out an original, robust theory of obesity that provides startling insights into proper nutrition. In addition to his five basic steps, a set of lifelong habits that will improve your health and control your insulin levels, Dr. Fung explains how to use intermittent fasting to break the cycle of insulin resistance and reach a healthy weight—for good.

The Obesity Code: Unlocking the Secrets of Weight Loss by Jason Fung

I got the cd. It’s great to listen in the car … constant spaced repetition. (BTW – my books are all available on USB … go to jurock.com/products.)

LIVE LIFE LARGE

As a man thinketh so shall he be in his heart

What you see is what you get

Believe it and you’ll see it

Thoughts become deeds – Idea before results

Belief becomes reality – Mind over matter

I know that if I want my matter to matter then I must mind my mind

Whatever is around me was a thought in my mind first

First, I create internally

then it manifests itself externally. ALWAYS!

Life is wonderful! I will think it so

I will grow into my future best!

Look up all the

“Grow into your future best” cards at: www.commitperformmeasure.com

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.com at 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment