March 5, 2021

OZZIE GOES POLAR BEAR – FOR A GOOD CAUSE

QUESTIONS, QUESTIONS – COMMENTS

WATCH THE 12-SPEAKER FORECAST VIDEO

THE NUMBERS, THE NUMBERS – FEBRUARY 2021, 2020, 2019, 2018

TORONTO AND SURREY – DOWNRIGHT SCARY!!!

JOHN WESTON SAYS: TRUDEAU WILL CALL AN ELECTION BY JUNE!

INTEREST RATES HEADING UP OR NOT? THE DEFINITE ANSWER

GOLD STOCKS GDP

HOW EXACTLY WILL THEY STOP THE CRAZY MARKET?

PRE-SALES ROCKING AND ROLLING

Did you miss LANDRUSH 2021?

THE MOST IMPORTANT

REAL ESTATE OUTLOOK CONFERENCE IN 28 YEARS

OR – EVER is now on video!

https://jurock.com/product/land-rush-2020-2021-video/

12 Ace speakers share their forecasts (details below)

QUESTIONS, QUESTIONS, COMMENTS

Q: How will they stop the crazy market? They have to raise interest rates, no other choice.

A: Actually “THEY” likely will not raise them, or rather cannot raise them. They have incurred too much debt, every country around the world. Increasing the rates would make the debt payments unaffordable. Already there are pension payment problems worldwide, etc., etc.

Similar questions:

- Have we ever had a runaway market like this? Yes, from 1979 to 2001 prices went from $78,000 to over $200,000.

- How did ‘they’ stop such a runaway market? They raised rates to 16.5% for 5-year money and to 21% for short term money … and kept it over 12% for 3 years.

- If not increase rates … what could governments do to slow the market now? Interest rates are not in the cards (likely not – but could be black swan). According to BOC:• Bank of Canada Governor Tiff Macklem so far has no plans to raise interest rates until the economy and following the slump cause employment are back on track.

• “In that low-for-long world, there are risks that housing could get carried away, so that is something we will be looking at very carefully”

Ok, no interest rate increases what else could they do?

- Increase the stress test to make it even more onerous.

- Reduce the amortization period to 20 years or lower.

You better believe they are “looking at it very carefully”!

Q: With March, April and May seeing big slowdowns in sales last year, this year will look soooooo much better, but it will create a false sense of what really happened.

A: Indeed

Comment: Last year Mr. Evan Sidall, the then CEO of CMHC forecast a 18% price decline! OzBuzz argued vigorously that this was nonsense, and I went on the Michael Campbell Money Talks show to refute it further. In fact, since Sidall’s initial warning in May 2020, the average Canadian home price has risen 25.7 per cent. Seven readers sent me yesterday the tweets by Mr. Sidall, where he admits – a full year later, he was wrong!

“In a series of tweets Monday morning, Canada Mortgage and Housing Corporation (CMHC) President and Chief Executive Officer Evan Siddall said unforeseen circumstances helped the domestic housing market avert the worse-case scenario, which CMHC had described as a potential 18 per cent drop in home prices from pre-pandemic levels.”

Actually his “unforeseen circumstances” is not an admittance, but … give me a break … he was sooo wrong.

Q: You are paranoid. “You will be taxed on things you did not even know you owned”. Ridiculous.

A: This was said with tongue in cheek of course. However, it is happening everywhere already. Today: “The B.C. government has proposed a law that would extend the rent freeze to the end of 2021, cap future rent increases to inflation and prevent illegal renovictions.” You say this is not taxation? The city of Vancouver increased its property tax by 26 percent in 4 years, at the same time, you cannot raise your rent…and if you leave it empty you have to pay 5% taxes (that did not exist before 2 years ago). So, maybe I should have said: Homeowner, investor developer, rental purpose home builder, etc., etc.: “You won’t know what you will be taxed as yet…”

Q: Several other questions on taxes…what could they tax?

A: As I said at Landrush. 1. Take away exemptions, like the residential capital gains tax exemption; or the space you claim as home office … could be declared as non-exempt; 2. Bring in a wealth tax (BC is analyzing it). Anybody that makes any money would have to share it with those who do not. Regardless of how hard you worked for it, how many years you paid for education etc. 3. Make all capital gains fully taxable … (now only 50%), or some greater portion of it. Etc.

Comment: Several people disagree with me on Canada’s upcoming election. The most prominent? John Weston, the former MP for West Vancouver – Sunshine Coast – Sea to Sky Country says:

“Who dares disagree with Ozzie? Well, I am sticking my neck out this time. Ozzie, you concluded the Federal Election will not happen soon. I am here to suggest Prime Minister Trudeau cannot resist the temptation to drive us to the polls by June. Why?

- He has received unprecedented, close-up-and-personal media coverage since the pandemic.

- He has triggered billions of dollars in COVID relief payments. Regardless of what you think of the wisdom of these payments, many recipients may return the favour with a vote.

- His main opponent, Erin O’Toole, becomes better known each day.

- Finally, there have been 3 provincial elections since COVID began, all of which increased the incumbent’s seat count: BC, Saskatchewan, and New Brunswick. In each case, the incumbent who triggered the election increased the number of seats of his party in the legislature. As cynical as it sounds, the incumbent has great incentive to go to the polls in a crisis, and Prime Minister Trudeau is no exception.”

A: Ok, ok, I did say…none this spring…if one, it would be June. I felt he would have problems distributing the vaccine…and be too scared to run… but get ready, Weston says it is a sure thing! (Read more about John Weston? See below.)

Q: You always seem to come down on the US dollar as going up. Yet, it continued down.

A: You are right, I looked it from the perspective as the US dollar being bad in a worse lot of other currencies. To quote eminent forecaster Martin Armstrong: “Despite the increase in the money supply, the demand for dollars is escalating dramatically around the world. The Fed has been increasing the paper money supply for the demand is rising exponentially. Of course, those who keep preaching the collapse of the dollar because of the increase in the money supply, fail to ever look beyond the shore of the United States. Even Canada has one of the highest debts among sovereign nations. The problem is that other nations, including Canada, have the authority to simply cancel their currency. The US paper money is the only one still valid from 1861. Consequently, for hoarding purposes, the dollar is still the #1 choice for it is the safe place to keep the cash. Also, the USA is not part of the reporting practices. So, foreigners can open accounts in the USA, and they are not reported back to their own country. As a result, the demand for dollars is rising and it is simply the prettiest of the three ugly sisters as they say.”

Ok, you place your bets…You make de money!

Q: I do not know what the reader who questions presale markets is smoking. Where we are (Kelowna) the market is going crazy! Downright mad!

A: As our pre-sale Pete Ryznar points out at Landrush…it’s hot everywhere!

Q: You were right on gold. It is down, down.

A: I cannot recall I said “down, down”. What I did say was that my preferred investment is real estate and compared gold performance to it… No contest. NOTE: Yes, gold had its worst month since late 2016. But understand that when rates rise, assets without return fall. So, as long as 10 years bond rates head towards 2% (no one – other than Michael Campbell – forecast the 1.68% we have today), pressure on gold could continue to be down.

Q: Found an assignment. Make $41,000. Thanks. Now to get the builder to accept the lower price. How?

A: Builder will not accept an assignment if it is selling at a lower price than other units. Best to pick up the phone and talk to the developer/builder directly. Since developers usually charge 1.5% to 3% assignment fee, they must have a procedure in place.

Q: First time I heard you speak at Landrush. I was impressed. Since then, I heard you at our mortgage conference and at a German meeting. You are everywhere. Tired?

A: Tired? Me? You do not know me. When people say: “Ozzie will you say a few words. Do you mind?” They do not know I would wrestle them to the ground for the mike… Nothing as sweet as my own voice.

Q: What ever happened to the survey?

A: Done… and thank you all participants…will share results shortly.

Q: Bond rate are soaring where will it end?

A: It is not only that they are soaring BUT it’s the aggressive speed of the bond rates rise – so triggering a sell off. It is clear, if you are a stock market buff (I am not) you need to understand: “The stock market fears interest rate risks”. While I believe, rates are difficult to raise … maybe, they will = just maybe they turn into that Black Swan … then ALL bets are off. (If the 10 year rate his 2% – be very, very careful.)

Q: At Landrush you talked about a ‘K’ shaped recovery. It has worked well so far in BC.

A: Well, not really. A ‘K’ shaped recovery helps some people benefit to excess (in BC probably 75% and more people never lost their job) and some suffer out of proportion. This disparity could create huge unrest and strife. This shift of wealth/income/savings from labour to capital, sees people at the bottom of the ‘K’ really hurt out of proportion!

Q: Is it a tough year ahead?

A: Depends on which forecast you believe. Employment – in a recovery will really soar. Also, the US is supposed to have GDP growth of 7%. That would be highest growth EVER! The Conference Board of Canada sees real gross domestic product (GDP) for Canada grow at 5.3 per cent! Sounds good…but from which bottom? And who all will participate?

Q: I agree with your annoying “promotions” columns and the fact they keep sending them even though they promise they would not. Easy answer: Do not open the top two (ads). They are reserved for rotating ads. If you leave the two there…no new ones can appear.

A: Ah so, wise internet guru… Works. Good tip. Now to pick 2 ads, that you would never open…ha-ha.

Q: I liked your “2 legs” and “skip transfer” answers. Can we ask you these kinds of questions?

A: Well, I just answered those 2. What are yours?

Q: Where do you see that electric car sales are only 3% of all cars sold?

A: According to Statistics Canada, electric and plug-in hybrid sales grew from less than one per cent of all light-duty sales in 2015 and 2016, to one per cent in 2017, two per cent in 2018, and 2.7 per cent in 2019. Story from Nov. 7, 2020. (There was also a report that electric vehicle sales fell sharply in Q2 2020). Do not read too much into my answer. When I state this fact…that is all it is. I agree that when Volvo and Jaguar are going all electric … those percentages will change… But really? Imagine we went to 100%. Where would we get the power? Without oil? You better hope that sales stay low as we mosey along on our way to the – whatever – future.

Again: If you are in the industry, in building, selling, marketing, developing lawyering, etc…,etc. list yourself in the FREE BC REAL ESTATE DIRECTORY: BCRED.CA

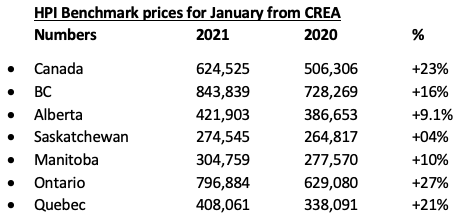

THE NUMBERS, THE NUMBERS IN CANADA

Toronto hits $1 million price first time in February…Etobicoke up 27% in SF price.

Ontario overall: The largest y-o-y gains – above 30% – were recorded in the Lakelands region of Ontario cottage country, Northumberland Hills, Quinte & District, Tillsonburg District and Woodstock-Ingersoll.

Y-o-y price increases in the 25-30% range were seen in Barrie, Niagara, Grey-Bruce Owen Sound, Huron Perth, Kawartha Lakes, London & St. Thomas, North Bay, Simcoe & District and Southern Georgian Bay.

This was followed by y-o-y price gains in the range of 20-25% in Hamilton, Guelph, Oakville-Milton, Bancroft and Area, Brantford, Cambridge, Kitchener-Waterloo, Peterborough and the Kawarthas, Ottawa and Greater Moncton.

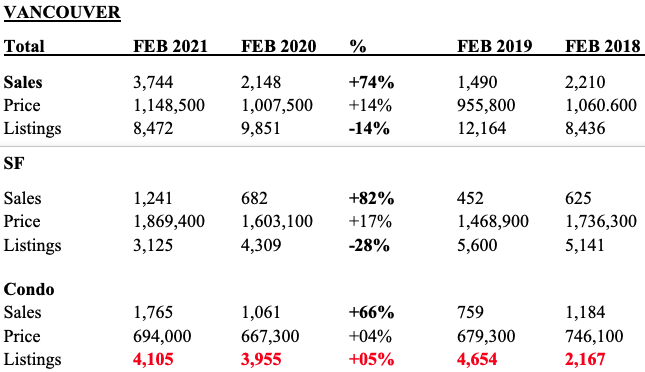

THE NUMBERS, THE NUMBERS VANCOUVER AND FRASER VALLEY/SURREY FEBRUARY 2021, 2020, 2019 and 2018

The Real Estate Board of Greater Vancouver reports home sales in the region doubled between January and February and have climbed by more than 70 per cent since last year.

February sales were so strong that REBGV says they were 42.8 per cent higher than the month’s 10-year sales average.

Major Point: We are running out of descriptions. Crazy market, record sales…etc., etc. But SF home sales are up a whopping 82%, condo sales ‘no slouch’ at up 66%. SF home prices up a roaring 17%! Listings down 28% – as last month on the SF home side. And condo listings? Well, they are still higher than last year…but now only by 5%.

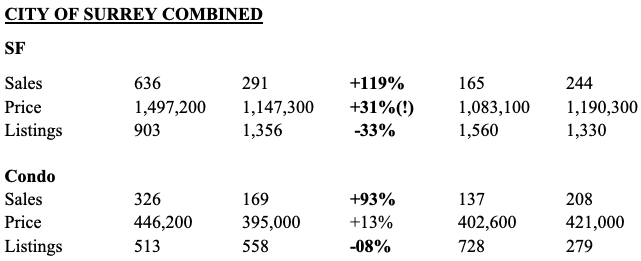

NUTS: Fraser Valley sales in total? UP 115%! Prices? +17%. Active listings? -30%!

The whole Fraser Valley market has gone ‘bananas’. As we predicted…values grow where people go, and people go where the jobs are…like in Surrey.

Major Point: SF sales up 119% and condos up 93%!!! Prices up for SF??? UP 31%!!! Prices up for condos?? UP 13%!!! Oh. This is the area where Jurock Case Investment Realty is closing 50 condo resales from 2 years ago? Oh, happy times!

Ozzie recommends that you vote for John Weston, Candidate for Nomination to run for the Conservative Party of Canada

John Weston is the former MP for West Vancouver – Sunshine Coast – Sea to Sky Country. At a time with all eyes on the relationship with China, John has decided to run again for a seat in the House of Commons. He lived in Taiwan for a decade, where I met him.

He learned Mandarin and developed a reputation for getting things done in government, law, and business.

During his last time in office, no MP got more private members bills through than he did.

His commitment to human rights and good government is well known, through his launching of the Canadian Constitution Foundation, and he is determined to help to improve Canada’s physical, mental, and spiritual health, as is clear from another foundation he initiated, the Canadian Health and Fitness Institute.

His emphasis on ideas over partisanship is evident through his “Things That Matter” webinar series featured at johnweston4mp.ca

I was impressed with him during my time in Taiwan. We actually created a tape : “14 ways to do business in Asia” – some 30 years ago! If you live in his area…you cannot go wrong voting for him!

Dear Friend,

I’ve got to tell you – I’m shocked at how many people seemed thrilled with the prospect of me diving into ice cold water in the Special Olympics Polar Plunge this Saturday. The fact that at my age this plunge could put me in real danger didn’t bother them a bit.

In fact, some people actually emailed to say that just the thought of me shivering, a light shade of blue, lying on the ground, warmed their heart.

You may think that I’d be offended but I’m not because I have to admit that the thought of Mike shivering, maybe a darker shade of blue, lying on the ground had crossed my mind given he got me into this. The only difference is that I’ll be in Lederhosen.

You might think that with my Germanic background that I’d be a hearty soul but as my wife Jo, will tell you – I’ve got soft in my old age. (I’m talking about my attitude not my body.) But I have an old family secret recipe for overcoming my allergy to cold water. I won’t share the whole thing but it involves beer, lager, and ale.

This Saturday is my chance at doing my ancestors proud and plunging into the cold waters of English Bay and raising money for all the athletes with intellectual disabilities. It’s not been an easy time for people who have Down Syndrome, fetal alcohol syndrome or Fragil X syndrome and their families. Activities have been cancelled and while Special O has done an outstanding job in easing their isolation within the COVID restrictions and guidelines, it’s not the same. But like everyone we’re hopeful the end is in sight and we’re working hard to make sure that Special O’s programs can be up and running as soon as we get the green light.

And that’s what the Polar Plunge is all about.

I hope your circumstances can allow you to help out by donating.

Simply go to www.plunge4specialolympics.com PLUNGE 4 (and that’s the number 4) SPECIAL OLYMPICS DOT COM

Click on donate and when it asks you to choose a Plunger you can search for Michael Campbell

Every donation over $20 gets a tax receipt straight to your email inbox.

All my best,

Ozzie

P.S. The slogan of this year’s event is Freezin’ for a Reason – Mike’s changed it to “I’m cryin’ because I’m dyin’.

LIVE LIFE LARGE

First. We create internally.

then it manifests itself

externally

My thoughts create my happiness.

My dominant thoughts create my life.

Every day I bring my thoughts.

into happy clarity

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.com at 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment