“There is no art which government sooner learns of another than that of draining money from the pockets of the people.” –Adam Smith

January 9, 2023

AGENDA

- THE MOST ASTOUNDING EARTHSHAKING, HEART RATTLING, EYEBALL POPPING NEWEST THING

- INFLATION/DEFLATION – WHICH IS IT?

- THE ASTOUNDING (AGAIN) YEAR END NUMBERS. UNBELIEVABLE?

- QUESTIONS,QUESTIONS

- CHECK YOUR ASSESSMENTS NOW! APPEAL DEADLINE 2 WEEKS AWAY!

- INTERNATIONAL, CHINA, EUROPE, USA – WHAT IMACT IF ANY?

- BEST MORTGAGE RATES? WHERE?

- WILL YOU SEE HIGHER PRICES AGAIN?

- RENTS ARE GOING NUTS

- WHAT TO DO?

INTERNATIONAL BUZZ

I have said it many times before, but it bears repeating. I am ONLY CONCERNED with what influences worldwide events could have on North American (US and CANADA) and their real estate values. Period!

Inward immigration is vital as a society. We are old people now, inflation worldwide means it will stay high here too, China as well as the Middle East, etc. is vital because of the large current Chinese/Indian/Middle East population already here in Canada. Canada’s ban on foreign buyers for 2 years is irrelevant, because of the massive immigration underway (1.5 million by 2024).

Also, I am not advising I am sharing my opinion.

EUROPE BUZZ

We talked about worldwide inflation and that Europe was harder hit, particularly England and Germany. Now forecasts show a ‘slowdown’ – the worst might be over. Huh?

In the EU the consumer price index in November dipped to 10.1% after peaking at a record 10.6% in the previous month. A slowdown then?

Also reports show that ‘the energy crisis may be easing for now’. Really? Energy price rose only 25.7%, down from 34.9% in November and 41.5% in October.

Major Point: Whichever way you like to slice it … inflation is not over. ‘Only’ 10% is not a sign of declining inflation. Europe is LUCKY that it has the warmest winter in years!

Steve Hanke:

“Short-sighted is the realm in which all governments operate. But the EU is really demonstrating that there is no natural pendulum forcing a swing from stupid to smart.”

CHINA BUZZ

China is in the middle of a massive economic crisis. In addition, its bet on Russia was a huge mistake. I mean, by any measure Russia is a third world country. Its per capita GDP ranks 84th in the world. Its regular GDP ranks behind South Kerea. So, clearly not a major player. To fight with the US (the leading world power) in favour of Russia is a joke. Watch China pivot towards North America this year. Already smiling at Canada (thru foreign office).

This Russia bet unified Europe and Nato and kept the US as the strongest world power. It also helped the US test its military might without risking the lives of US (and Canadian) army personel. The war also showed

- Russians no longer know how to organize a war, a supply chain, an economy … anything

- The US sanctions ARE working

US dollar is the currency of reserve but also the currency of international trade. Not the ruble, or the yuan! And that will remain that way. In the meantime, India has taken the place in immigration in Canada.

Major Point: Please note, I love Asia. I love China and Taiwan having had the privilege of running a Real Estate Management company as CEO in Taipei. So, in this context, we only care about what China (or the world) as investors/immigrants in our real estate markets may be acting on.

CANADA AND THE USA ECONOMY BUZZ

Is there an economic crisis worldwide? Yes, there is, by any measure.

- Our YouTube and TV experts are endlessly debating whether or not we are going to have a “recession in real estate” this year, and meanwhile real estate activity is imploding all around us.

- The number of properties sold in BC is down 50 – 60% over 2021.

- The active SF listings are soaring 169% in TO and 134 percent of the Fraser Valley.

BMO chief economist Douglas Porter is predicting home prices slip another 12 per cent and sales fall another 15 per cent. He says no rate relief till 2024.

In the US, overall, existing home sales in the United States have fallen for 10 months in a row and are now down by more than a third since January 2022, 35-40% declining further every month,

- Amazon is laying off thousands of workers.

- Old stalwart companies like Bed Bath & Beyond are literally on the verge of declaring bankruptcy…

- Tech in general is laying of thousands

- The Federal Reserve has declared war on inflation, but prices continue to soar.

- Vegetables are 80 percent more expensive now than they were 12 months ago.

- Financial markets continue to plunge.

- Some Blackrock funds and others stop redemptions to its investors.

- A third of the value of the Nasdaq ( over half more than 50%) has already been lost.

- Two-thirds of the value of all cryptocurrencies is already gone. (Bitcoin alone went from $69,000 to $16,800 and even NFTs are big losers.)

Major Point: Everyone should be able to clearly understand what has been happening. The first quarter will make it look worse as all of main street media will now be comparing stats from Feb 2022 to February 2023, which to them, will be an eyepopper. Of course, you, dear reader have been aware of the falling prices for 10 months and sold all your losers.

INFLATION/DEFLATION BUZZ

Michael Burry ( who forecast the collapse of the US housing market in 2007 says in his tweet of Jan 1:

“Inflation peaked. But it is not the last peak of this cycle. We are likely to see CPI lower, possibly negative in 2H 2023, and the US in recession by any definition. Fed will cut and government will stimulate. And we will have another inflation spike. It’s not hard?

Peter Schiff (who is a – self-appointed – gold YouTube guru) replies:

“CPI inflation is unlikely to fall as low as 2%, let alone go negative. But I agree with you that the Fed will return to QE and the official inflation rate will hit a new high. The unofficial actual rate will hit a new all-time record high”

I could also quote Goldman Sachs and others – each defending one or the other end of the spectrum. Most are in the ‘for sure a recession’ camp, but job numbers hold stubbornly on.

What worked in the past won’t work now!

Major players like Blackrock see inflation as here to stay and high at that. Blackrock’s corporate earnings have been hit hard already, So, they say: A very turbulent year ahead. They also feel that stock markets crash following a recession. What does Blackrock do – apart from trying to invest your money with them – ulterior motives? They buy farmland like bill Gates…

Fact is: No one knows! Unchartered waters.

Major point: In our view, if the world goes into recession together (Europe is in economic hell) or if central bankers collaborate together and refuel/reprint (a la Burry), that will make a huge difference on how we should best govern ourselves.

Sidelines look downright tempting!

In the meantime, THINK! If you listened to our opinions, you have a large chunk of cash.

- Investing in stocks from a taxable account if you have a 5% mortgage, does not make sense. Remember: While on the sidelines you get a 5% return just by paying down your mortgage. Risk-free, after-tax.

- Short term safe government bonds pay 4%-5%.

In our opinion Inflation will remain high for 2023, recession is likely in first quarter, real estate prices will continue to fall – but we are getting closer to a turning point. Also, once we are thru the valley (we always muddle thru) prices will recover. But not yet.

Primary goal? It is the return OF CAPITAL that you must have in 2023, Not the RETURN ON CAPITAL that you need at this particular time.

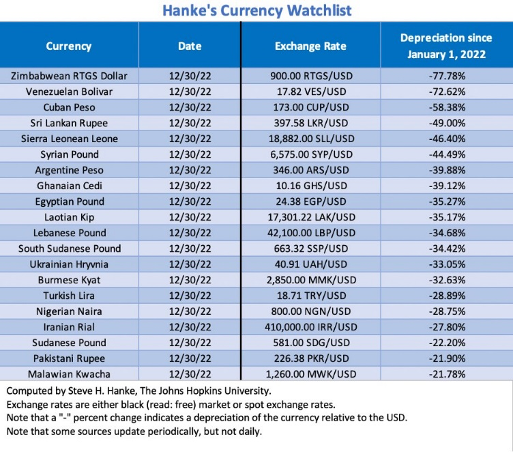

I like Steven Hanke’s ‘true inflation’ charts. Last month he showed what Governments are reporting versus the truth. Blew me away. I always knew they lied! Now look at this top 25 percent losers in their currency in one year!

hankes currency watchlist

US / CANADA MORTGAGE BUZZ

The 30-year fixed-rate mortgage averaged 6.48% in the week ending January 5, up from 6.42% the week before, according to Freddie Mac.

A year ago, the 30-year fixed rate was 3.22%!

In Canada (as of Jan 6) Refinance (changing your mortgage amount) rates: 5-Year Fixed at 4.89%. 5-Year Variable at 6.10%. Terms and conditions apply. Lowest rates are for high-ratio mortgages (LTV > 80%).

Best rate comparison website: https://wowa.ca/best-mortgage-rates/5-year/fixed.

Remember prime rates determine short term rates. Bond markets determine long term fixed rates. (Getting a professional mortgage broker is vital today.)

Right across the US and CANADA would-be buyers have little appetite to get into the market now. Also, sellers are not rushing to sell either. Why?

a) Sellers can’t get used to the idea of the 30% or more decline in the price they ‘used to have’ a year ago.

b) They aren’t interested in parting with the ultra-low mortgage rates that were available for the past few years.

“Mortgage application activity sunk to a quarter-century low this week as high mortgage rates continue to weaken the housing market,” said Sam Khater, Freddie Mac’s chief economist.

US / CANADA DOLLAR BUZZ

Q: Am I reading your last OzBuzz correctly? You are still calling the US dollar the world’s reserve currency but note that converting US holdings to Canadian may be a good move between 70 cents and 73 cents?

A: Remember we are talking about the many subscribers that are now investing in the US. Most have made huge profits and are wondering whether or not to bring the money home. If you can make 30% of your money and buy into a real estate market that is down 30%, maybe the ultimate best move AT THIS TIME!

CANADA DOLLAR BUZZ

We have steadfastly stood by the view that our Loonie travels with commodities and in particular oil. However, since we are married (happily) to the US economically we benefit from US dollar strength and also hurt when the US dollar hurts.

WHY REAL ESTATE PRICES MUST AND WILL BOTTOM

I received countless (countless!!!) questions on ‘wither the market, etc.’ The only answer?

I have held the unshakable belief (for 30 years) that overprinting of money results (always) in inflating of hard assets. Particularly real estate assets. I wrote it in 5 books, addressed it at 50 or more major speeches to 500 plus people and every month in my monthly group.

In fact, I mused in my 1998 book “Forget About Location, Location” that if we kept printing money every house in Vancouver by 2033 would be worth $5 million.

But I also said that we don’t go there in a straight line and have added the tenets of timing, trend, and cycles. No details necessary – visit Oz Buzz 38-42 and get details of my philosophy.

So, yes, we will have higher prices again. But not until we have gone thru the ‘valley’!

I have learned that there always will be an inflection point. The faster out prices increase with FOMO, the faster will be the decline after- ALWAYS!

So, timing is the issue now…

The trend is down … and the building cycle won’t get started again at least not in a major way till 2024. This time our cycle will be longer.

To a large extent our real estate markets are psychological.

Major Point: So, simplistically: Sell when you think the market is gone ahead of itself and buy when you think a new low range has been achieved. Do not believe in the end of the world. We have been there before many times (I pointed that out in my speech, September 10), we always came through and at the worst outlook it was a great time to buy.

We have raced higher, we now are racing lower and will continue to go lower for a while longer, But for the astute investor, troubled times spell opportunity,

I have never heard people say, I paid too much but at least I bought in a good market. A good market for the seller yes, but for the buyer you want fear, bad news, foreclosures. So, investors learn some new concepts:

- Stink bids.

- Get a good realtor that understands the concept.

- Don’t fall in love, it is an investment

- Make offers, make offers

- Keep your eye on a specific market segment

- Look for troubled owners

- Sit in local court to learn the foreclosure process

- Buy a deal of a lifetime

- Learn the concept: So, what? Next! There is always another train coming.

If you – like me – believe that higher prices are always the eventual outcome, stay in cash, but look , study the principles, make offers, stay engaged. And stop the fear. The outcome of our current excesses will always be higher inflation – eventully…but the negative valley has to be crossed.

THE MOST ASTOUNDING EARTHSHAKING, HEART RATTLING, EYEBALL POPPING NEWEST THINGS

It is called chat GDP

Long term subscriber and real estate ace Richard Morrison sent me this new “search engine;” called chat GDP.

I did not think much about it – so many things going on – but when I took the time to play with it (free) it blew me away. This is a brand-new way to write letters, get specific information. It is a tool that has a unique way to communicate efficiently and effectively within organizations, and I believe that it has the potential to revolutionize the way we work (and play).

Type in “quantum mechanics and real estate” – it writes an article. Ask a question on how to write a newsletter it gives you a 15 point business plan. Its magical: and if you want to play a silly game ask it anything. My prompt was “teach me about investing in real estate as if I was a dog”. It answers: “Here are some key points to consider when investing in real estate, explained in a way that even a dog could understand:

1. Location, location, location! Just like how you sniff out the best spot to bury a bone, it’s important to do your research and find a property in a good location. Look for areas with strong economic growth, low crime rates, and good schools.

2. Size matters. Just like how you might prefer a big, cozy dog bed over a tiny one, bigger properties tend to be more desirable to renters. However, they also tend to come with higher maintenance costs, so it’s important to find the right balance.

3. Don’t be afraid to ask for help. Just like how you might ask a human for a belly rub or a treat, it’s okay to ask for help when it comes to investing in real estate. Consider working with a real estate agent or financial advisor to help you navigate the process.

4. Keep an eye on the market. Just like how you might keep an eye on the bird feeder in your backyard, it’s important to stay up to date on market trends and conditions. This can help you make informed decisions about when to buy and sell properties.”

Amazing! We hear that Google has a taskforce studying the impact and that several school districts in the US have forbidden the use of chat GDP.

Major Point: This will MAKE YOUR LIFE simpler and MORE INTERESTING but also more scary.

QUESTIONS, QUESTIONS

Soo many lovely letters of support for my year end musing about how grateful we are (OR SHOULD BE) that we live in Canada and in the west. One dissenting voice, that in a lengthy but well laid out reply feels that Canada was desirable once but is no more. Dear Sir, 450,000 newcomers this year would disagree.

People just don’t understand democracy.

Winston Churchill said: “Democracy is the worst form of government. But it is the best we have.”

Q: Looks like Canadas goal of 1.5 million immigrants in 3 years is right on track. They bring with them not only themselves, but their religions, their habits and they change our society. What do you say?

A: Not sure what you are after. We are an aging society. We need people! Working people, young people – pay our pensions.

Q: . Ozbuzz is way ahead of the curve. It hit me the other day reading Oz buzz last summer you pointed out that Evergrande was the biggest condo builder in the workd and it might be defaulting. No one else reported it till late last year. You told me to get into cash, sell my condo and that the market was crashing (I am in Toronto).

In the meantime, the Main Street was reporting increasing real estate prices the US dollar to fall, etc. It hit me then that your free newsletter is better than the paid subscriptions I had. cancelled them all. I mean look at the numbers you forecast every month. Brilliant.

A: Blush. Just to make sure: You are not my mother or father, right? You are very kind. I was not however the only one on Evergrande or the several others but I pointed out that China’s real estate MARKET was in trouble and with the Chinese population massively involved in real estate this was a foreboding of things Chinese to come. Real Estate is THEEE major economic driver in China, so people losing money will have an impact how they will act,

Again, I am only – as above – reporting what I think may make a major impact eventually on real estate in NA ..

As far as THE Numbers go. I have reported them faithfully for 28 years…nothing new here. I believe in reporting actual numbers very month but also compare them to

- The previous high in the market

- The last 4 years

A: No it does not, pre-sale contracts fall under a seven-day rescission period under section 21 of the Real Estate Development Marketing Act;

While I am at it, it also does not apply to leased land (such as First Nation leaseholds), • residential real estate sold at auction; and residential real estate sold under a court order or supervision of a court.

Also, of course, it applies ONLY to subject free offers. If you already have subject clauses in the contract, they matter first.

“When you walk the walk, whether successful or not, you feel more indifferent and robust to people’s opinion, freer, more real.” – Nassim Taleb

TOILETS OF THE WORLD

When you absolutely need more room:

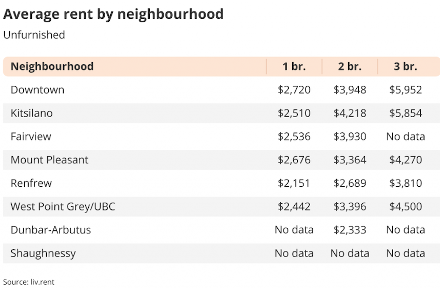

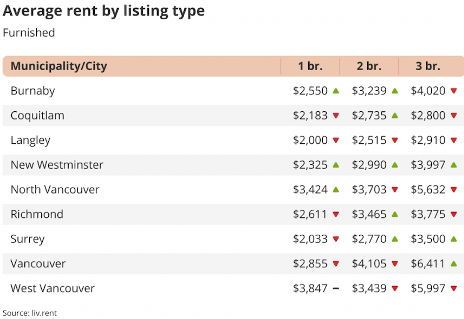

RENTS ARE GOING NUTS!

Read in the fine: “Vancouver is Awesome” newsletter.

According to the great report by Liv. Rent: Apartments, Condos, and Houses for Rent in Canada

…. at the start of 2022, the average cost for an unfurnished one-bedroom in the Lower Mainland was $1,827, which is a whopping $400 lower than the average price for the final month of the year, (now $2,227). Full report at Liv.rent. Look below and be astounded:

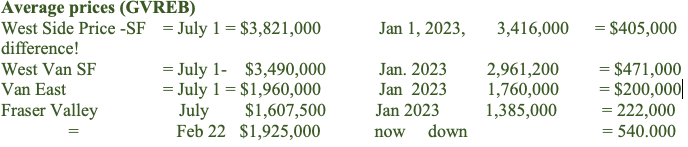

CHECK YOUR ASSESSMENTS NOW!

As of January 4, your assessments are in the mail and you can check your personal new house assessments at bcassessment.ca. (Any property anywhere – type in address.)

The kicker:

a) That’s the value your tax will be based on (Vancouver debates 5% tax increase)

b) That’s the value as of July 1, 2022, NOT JANUARY 2023.

C) EXAMPLES:

What can you do?

First get all comparable to the price that similar properties (in your suburb) recently sold for.

Look at all properties the BC Assessment Authority used to arrive at your value

Use your favorite realtor for this.

The Assessment Authority will argue that it is the July number only that matters. You may disagree ( it is your right) and show how much your value has dropped. Compare your property, study differences ( renovations done or problems, etc.).

You have till Jan 31 to dispute

Before filing a complaint (appeal), use Assessment search must review your assessment and sales of similar properties to ensure your assessment is accurate.

If you still have concerns, contact by call or email before submitting an official Notice of Complaint (Appeal).

Please note that the deadline to file a Notice of Complaint (Appeal) in BC is January 31, 2023.

Alberta deadline to file an appeal is March 13, 2023, for Calgary and March 24, 2023, for Edmonton.

Ontario deadline (Toronto has a four-year assessment cycle) is March 31 of the tax year for annual assessments, or 90 days from the notice date for other types of assessments

FIRST QUARTER BAD NEWS

- Main Street media will report the Feb 2022 (high) and the Feb 2023, a general far larger decline than average buyers were expecting (You, dear reader read it every month!)

- Psychology will be more negative.

- More projects will be cancelled or moved forward.

- Governments – New 3-day cooling period, etc.

- Active listings are increasing dramatically.

- Sales down 60%.

But there are always opportunities. I’ll talk about them below.

===========================

For other industry experts, the consensus seems to be that home prices will slide in 2023, but that a bottom might be in sight.

Important repeat:

LOWER MAINLAND INVESTORS Note:

- The high in the average price came mostly in Feb (Ma/Apr) 2022!)

- As prices declined every month since February (and we reported this to YOU) prices were quoted in some media as being UP and that is correct if you measure prices of today against prices of DECEMBER 2021. However. Already prices compared to December 2021 are sharply lower (Fraser Valley SF home is shown to be down 20% – Board stats) Dec over Dec. (you know that it is down 30% over Feb 2022!)

- Result? As buyer keep reading these astounding numbers (particularly Feb 2021 over Feb 2022) they will psychologically impact to back off.

- The high came THIS February as we told you in our February: ‘THE HIGH IS IN PLACE’ headline,

- You, dear Oz buzz reader are not surprised. As more and more people will be running – look below for – tremendous opportunities ahead!

Major Point: Price declines THIS year are continuing in all sub-areas every month and that for 10 months!

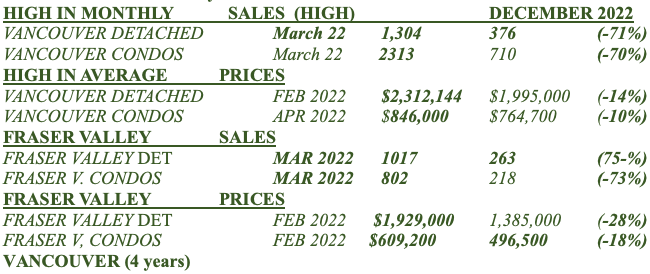

NOTE:

For the ‘real market conditions’ we show the 2022 HIGHEST MONTH (first).

For ‘additional review’– as usual (and as we have since 1997) – we report the DECEMBER over DECEMBER results for 4 years further below.

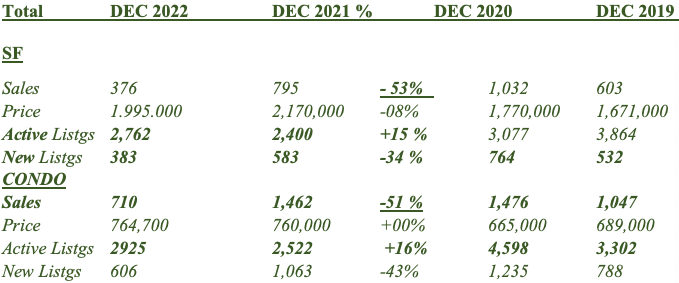

VANCOUVER (4 years)

Again:

- Here we are looking at a 4-year DECEMBER over DECEMBER comparison.

- Remember to take the 2020 comparisons with a grain of COVID salt!

Snapshot:

SF: REBGV reported SF sales declined a further 53% over DECEMBER 2021. The average price achieved in April of $2,312,000 is down by $310,000 – or 14%!

CONDO: REBGV reports condominium sales are down 51% over DECEMBER 2021 sales. The condominium average price is down by 9% from April.

- Then note the 4-year comparisons – High in everything for the last 4 years was March 2021.

- Major Point: Note to downturn from the high in the opening. Then note increase in active listings – up 15 % for condos and SF. Active listings are way up in VF (condos up 136%)

- Study the above at the opening comparison of the ‘high in sales’ (usually FEB/March ) and the high in Vancouver prices (usually February 2022) and note the sharp declines in all sales and continued declines in all prices.

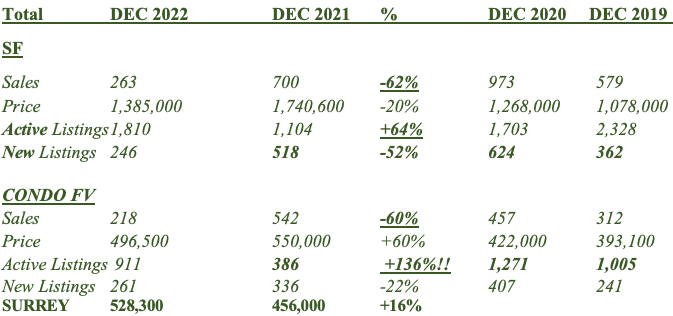

FRASER VALLEY

SF home sales continued their sharp downturn (-62%). Prices are much lower. Active SF listings (+64%!) and condominium listings up a whopping +136%! Condominium sales cracked as well, down 60%.

Fraser Valley (GAMBIT STORY ABOUT TAKING A MOVE BACK)

The numbers tell the story. Look at intro to the numbers and the comparison of February 2022 to DECEMBER 2022, a 31% decline in single family home prices, 16% down in condominiums.

MAJOR, MAJOR POINT: Again, as we said on February 9: THE HIGH IS IN PLACE. For the last 10 months we pointed to a changing market…before the interest rate changes really clocked in and the stock market and crypto crashes. Now, the very (too?) fast increases in rates really start to bite. We expect that to reach a new plateau (we are close).

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

Moneytalks Podcast

Ozzie, Michael Campbell, Michael Levy and Victor Adair and guests are now on podcasts every week: https://omny.fm/shows/money-talks-with-michael-campbell

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment