August 13, 2023

“Bill Gates owns 4 private jets: 2 Gulfstream G650Ers, 2 Bombardier Challenger 350s. Each one of them emits more carbon in a single flight than your car in your entire lifetime. But its ‘s your car that’s causing climate change!”

Spectacular cash flow! AirBNB in the suburbs! Tricks of trade. Finance them, run them, huge profit

Call or write Kelly Fry | CPA, CA – Keller Williams Elite Realty

604-418-3162 | kfryhpi@gmail.com

7 MUST KNOW Mortgage 2023 secrets. Best rate, which term.Pre-sale financing, private money. NEW RULE!

Kyle Green: Email us at Info@GreenMortgageTeam.ca to get the term chooser calculator. It compares whether a shorter or a longer term fixed option is better by looking at the break-even rate, and compares a fixed vs a variable mortgage to see which one may result in less interest overall.

AGENDA

- MISLEADING HEADLINES – MARKET IS NOT HOT

- GET FIRM PRE-APPROVAL FOR 24 MONTHS

- GOT DIVORCED? DON’T SELL THE HOUSE!

- US DOLLAR REIGNS

- CHINA MASSIVE COLLAPSE IN ITS HOUSING MARKET

- CONVERT SF HOUSES IN A 6 PLEX? NO WAY, JOSE! YOU LOSE!

- STRESS TEST AT 8.49%!

- TRICK QUESTION OF THE MONTH

- THE NUMBERS ARE BETTER IN JULY OVER 2022 BUT NOT 2021/2019

- QUESTIONS, QUESTIONS

- OZBUZZ SERVICES CONFUSION?

- 27 BANKS DOWNGRADED OR PUT ON WATCH BY MOODYS

- 70 BANKS ON WATCH BY FITCH – BE VERY, VERY CAREFUL OUT THERE

- OZZIE A DJ WITH 15,200 LISTENERS?

MISLEADING HEADLINES

There are a lot of misleading headlines about the Lower Mainland real estate market. Headlines scream that sales are double, market is hot, etc.

BUT AS LAST MONTH – LOOK AT THIS:

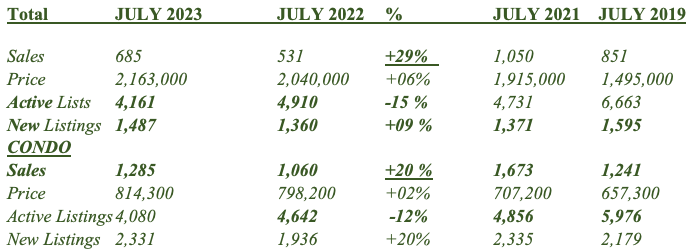

1. Brief July highlights of Vancouver and Fraser Valley.

VANCOUVER

YES! SF sales are up 29% over 2022 (531). BUT: Sharply lower (50%) than 2021 (1,050) or 2020 (1,130). Also Note: Vancouver New listings are UP 9% in SF homes, UP 20% in condos.

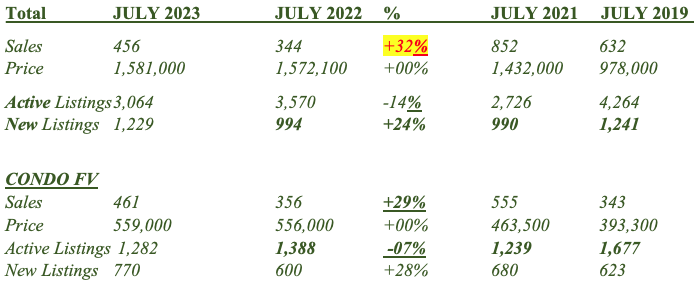

FRASER VALLEY

YES, sales are higher over July 2022. BUT July sales of SF homes are still much lower than 2021, 2020 or 2019. Sales of condos lower than 2021.

NOTE: Fraser Valley SF new listings are up 24%, condos up 28%.

Interested in buying, get a quality Realtor, study the best Stats of the V and FV real Estate Boards for your specific subareas and take a breath.

More and more mortgages are coming due to be renewed. That’s why new listings are up…

Headlines are meaningless until you compare the relevant numbers in the stats below!

CONFUSION

There is some confusion about what services Ozbuzz.ca actually offers. Thanks for sharing concerns.

Actually, there seems to be some ‘doubling of what we do’. Ok Here it is:

- Oz buzz blog – You are reading it. All issues past and present are online – except the most recent one – which goes to email subscribers first. So, you want it fast, put in your email. Still free.

- Oz cast – podcast. All podcasts are on Ozbuzz.ca – but also (hence the confusion) on youtube.com/jurockvideo.

So, if you just wanna listen to Ozzie’s podcasts you can do it here:

Amazon music, Apple Podcasts, Soundcloud, Pocketcasts, Spotify, Ozbuzz.ca - You wanna see the videos? Go to Youtube.com/jurockvideo

The doubling? We put the last 20 podcasts on YouTube as a video and on podcast as sound only.

A LOT OF INQUIRIES ON VANCOUVER’S NEW PROPOSAL: DOING AWAY WITH SF ZONING (The SF density plan)

Some owners are (rightfully) concerned about having their neighbours tear down their fine homes and replacing them with a 6-plex. Some 52% of Vancouver’s zoning could be changed under the new proposal. Build a 6-plex and also get more buildable square feet than a single-family house. Now, a new SF unit can only occupy 60 per cent of the lot’s area (2,400 square feet on the typical 33×122 Vancouver lot). But the new 6-plex can go up to 4,026 square feet on that same lot.

Major Point: THINK TWICE. SF density plan will hurt owners more than they think!

This plan in Vancouver exposes property owners to:

- Loss of capital gains exemption on residential property, if not carefully managed. How much, analyze before you build! Maybe sell the property first and lock in tax free gain! But analyze!

- Note paying the property transfer taxes (7), GST on any new builds, creating Strata council, managing it and strata fees. Nonexistent parking must be found (Cost?).

- Building permits on a laneway home run into $50-60,000! Times 6?

- Construction costs still rising.

Even just building a laneway home today reduces your free capital gain exemption and if you did do the conversion in the one year after you bought new … Trudeau says: “it is now income” if you convert residence into condos.

Major Point: Seems like Governments would make more than owners on this initiative. (Something we have warned about.)

TRICK QUESTION OF THE MONTH: OH, HERE IS VICTORIA

Victoria already has approved the conversion to 6-plexes since January. They call it “The Missing Middle Housing – Creating diverse housing options in Victoria”.

TRICK QUESTION: How many eager homeowner/would be developers have applied for the permit (s) in 8 months? Answer: NOT even one!

https://www.cheknews.ca/missing-middle-housing-initiative-is-missing-in-victoria-since-vote-1162912/

CHINA

A YEAR AGO, Ozbuzz alerted you to the default of Evergrande, Country Garden and other Chinese developers. Of course, in China when a bond date is simply extended without a vote by the bond holders it is not called default… just a re-adjustment. Extending bond terms in China is not seen as what it is. IT IS A default!

Well, this August foreign bond holders saw their ‘Country Garden’ and Evergrande bonds collapse by over 50%! The new promise of expanded date (with a promise to pay) no longer works. No one believes it. Morgan Stanley saw Country Gardens default 75% on its bonds. The result is a rout (August 8-10). Massive liquidity issues.

China is in outright debt deflation starting with the property sectors. Property woes are spreading. The possible worsening property crisis, we talked about 1 year ago is now in full force. 20% of China’s economy is comprised of real estate and when developers don’t/can’t perform it is a royal mess. In China when you buy a pre-sale, you must pay the full amount up front. Thus, your mortgage payments do not start when the building is finished like in wonderful Canada, but immediately. Think about all the unfortunate Chinese buyers (1.5 million of them and more) that MUST pay a mortgage and the condo is not being built. Arrrgh…

Add to this hard new lending, no help from central government for buyers. There is some help to banks. Now, there is a report of a 15-year plunge of loans, etc. All this means “Contagion risk.”

Major Point 1: Surprisingly money is galloping out of China. Some will find its way here .

Major Point 2: This crisis of confidence in China – and elsewhere – makes India the cleanest investment story area in Asia. Even Indonesia with good strong demographics is now a safer place.

BURNING MORTGAGE QUESTIONS

We asked Kyle Green (604-229-5515) to answer these questions:

What is now involved to qualify for a mortgage:

Currently if you have no other debts and are qualifying for a residence, you qualify for about 400% of your income (4x your income). This used to be 5x when the stress test was 5.25%, not ~8%.

I need to renew a mortgage – how much is a private mortgage now?

Private money is about Prime +4%, give or take. Some strong borrowers can get money closer to 9% but on average it is closer to 11.2% (Prime +4%)

How do I select the best term in my circumstances?

Email us at Info@GreenMortgageTeam.ca to get the term chooser calculator. It compares whether a shorter or a longer-term fixed option is better by looking at the break-even rate and compares a fixed vs a variable mortgage to see which one may result in less interest overall.

How long can I get a firm preapproved mortgage commitment?

You can get qualified for an 18–24-month rate hold and approval. You will be secured on the rate if rates keep climbing up but can also drop the rate to their current market rates at closing as well. On top of this, you can qualify now and that way if your financial situation changes in the future, you are still covered.

QUESTIONS, QUESTIONS

Q: My wife and I are divorcing. It is amicable, but we need an arbiter to help divide assets and a realtor to sell the house. Can you help?

A: My answer may surprise you. If you are amicable and you have a house – stay there! I know a couple that had a $1,900 mortgage payment, divorced and then each is now renting at $2,300 per month. Separate ok, amicable, ok … but stay in the house together. You will be better off.

Q: You seem to be against immigration. Don’t we need immigration in an aging population?

A: I am an immigrant. Yes, we do need immigrants, plus we are not even replacing ourselves. But it is (like interest rate increases) going to fast too hard. Massive immigration is bad for all infrastructure in all cities. Parking, hospitals, parks, amenities, schools, all government services. In Germany for a while, they had to put immigrants into basketball courts and repossess private residences (Hamburg) to accommodate the inflow. We want immigration but 1 million people quickly had already massive unintended consequences. Now, we are moving the multitude into hotels … where next? Our immigration minister even promises an increase in immigration!

Q: I saw in the SUN that businesses are leaving West Vancouver and Point Grey.

A: Not all businesses, but restaurants, coffee shops – community related. They can’t make any money. People don’t shop local, they order from AMAZON etc. It’ll get worse. I predicted the collapse of most shopping centres and reported the closure of over 2000 such centres in the US 2 years ago. We are in a massive change … really, really look at your changing world and take action.

Q: My pre-sale mortgage is due on a building closing this fall. I have anther condo closing in 2024. What solution is best?

A: Not sure what the questions is. Rates? Qualifying etc.? Best answer? Watch the video by Kyle and in particular read his advice on presale mortgage pre-approval below!

Q: I know why you want our email. Ever since we subscribed to your letter we get inundated with ads.…

A: Untrue. I resent that. Ozbuzz accepts/sells no ads, not even posting from others. Oz buzz sells no mailing lists. Oz buzz advertises only its own events – such as Land Rush. We want subscriber’s email, so we know who the 23,000 (or so) subscribers are. We do not answer questions relating to the publication if the questioner is not a subscriber. You do NOT have to log in your email … just wait 10 days after we write it and it will be posted on ozbuzz.ca.

Q: You have always forecast a stronger US dollar. Everyone I followed said it was going down – paper currency – and all that. What about 2024?

A: I based my opinion on people like Victor Adair VictorAdair.ca, who always maintained that the US DOLLAR is the cleanest dirty shirt. I would add that it will remain the reserve currency of the world … like it or not. Who would pick the euro – when several countries want to leave the EU? Crypto? Haha. Who would pick the REnbi, with China’s huge problems (forced to lower rates)?

Q: I enjoy your revenge of the little man. Don’t stop it. We need the voice of reason.

A: Haha, but when it took over ALL other subscriber questions, I find myself wondering what is the voice of reason? It is a crazy world we go into. They say the crazy excesses of the LGBTIQQ COMMUNITY etc. is driven by the marketplace. That’s nonsense, they are driven by a minority, woke marketing companies and one wonders what happened to free speech. Companies seem to want to become our moral tutors and go beyond tolerance and beyond what the public wants. Anheuser said to its customers actually: We don’t like you.

For all of us who are getting older there are precedents where vocal fighting minorities inflict their views on the apathetic majority.

I say there should be tolerance, but there is a difference between tolerance and endorsement.

Q: I enjoyed your graph and the 50ish year history of 5-year mortgages rates. I sat down my kids and read it out loud. Only in 5 years rates were below 5%!

A: Yes, so today’s 5-year terms fixed at – between – 5.99% and 6.09% are in line with the past. What is new is the Stress Test (now at around 8.3%).

Q: Where were you on Blip.fm? Really 15,000 listeners?

A: Look below 15,262. Blip.fm It still exists but it is now run by Spotify….

Last gif of DJ 77Ozzie:

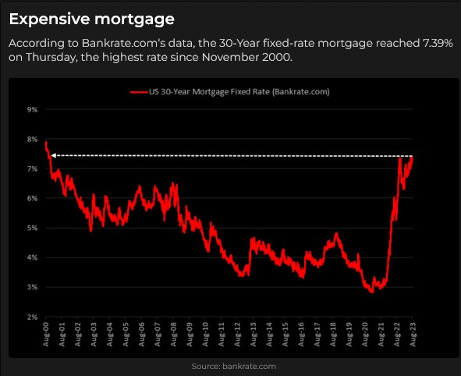

US INTEREST RATES

US 30 YEAR MORTGAGE IS AT A 23 YEAR HIGH THIS WEEK… 7.59 PERCENT.

According to Bankrate.com‘s data, the 30-Year fixed-rate mortgage reached 7.59% this week, the highest rate since November 2000.

This increase was driven by a notable surge in US Treasury yields, which serve as a reference for mortgage rates.

The spike in yields was triggered by:

- concerns among bond investors about an influx of government-debt issuance,

- the strength of the job market, and

- a downgrade of the sovereign credit rating.

Additionally, Japan’s recent tighter monetary policy contributed to this trend.

As Japanese long-term yields rose, the largest foreign holders of US Treasuries, Japanese investors, became less interested in US bonds and demanded a premium. US and Canada are dependent on foreign bond buyers! Can you imagine China selling US holdings?

RESULT?

a) Mortgage purchase applications decreased by 3.2% on a seasonally adjusted basis from the previous week. The index dropped for a third straight week, with a total fall of 9.5% over the past five weeks.

b) Adding to this, the soaring mortgage rates have significantly impacted housing affordability since February. In fact, Redfin report highlights that the typical U.S. homebuyer’s monthly mortgage payment was $2,605 during the four weeks ending July 30, representing a 19% increase compared to the previous year.

THE US WAS DOWNGRADED – END OF STOCK MARKET INCREASES?

MORE IMPORTANTLY FOR THE US:

10 BANKS DOWNGRADED BY MOODYS…

Here’s the list of banks downgraded:

The largest lender to receive a lower rating is M&T Bank, the 19th largest U.S. bank by assets, according to the Federal Reserve.

Commerce Bancshares

BOK Financial Corporation

M&T Bank Corporation

Old National Bancorp

Prosperity Bancshares

Amarillo National Bancorp

Webster Financial Corporation

Fulton Financial Corporation

Pinnacle Financial Partners

Associated Banc-Corp

Major Point: Moody’s added: 6 BANKS WITH RATINGS ‘UNDER REVIEW’, 11 BANKS WITH ‘NEGATIVE OUTLOOK’. That means a total of 27 banks possibly in trouble.

OLD STYLE ROCK OF THE MONTH

- Is that the question? If so…who answers, but…hey I’m still alive.

- Pearl Jam: https://www.youtube.com/watch?v=0unH11yjklE

(Look below for a totally biased selection below The Numbers)

THE NUMBERS, THE NUMBERS

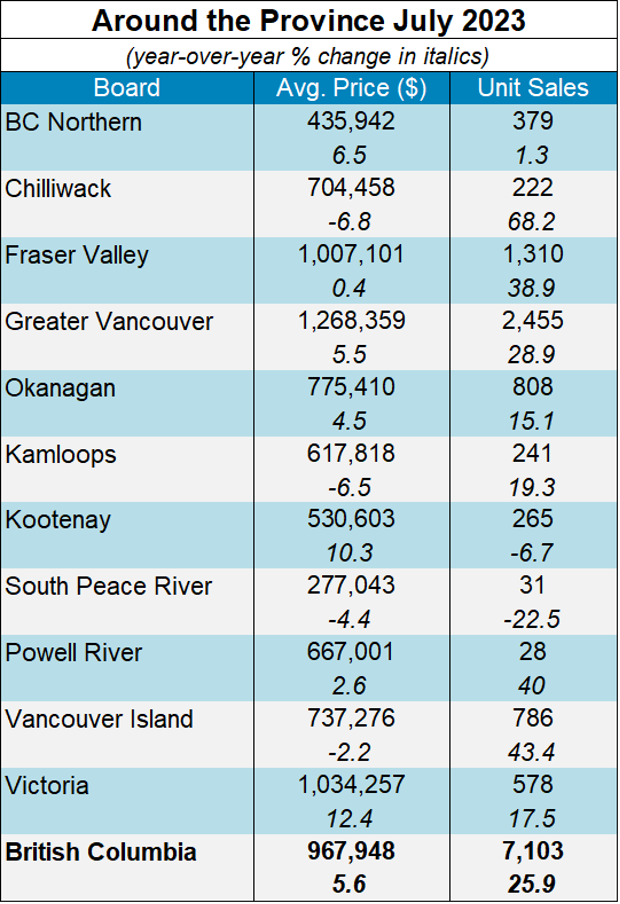

BRITISH COLUMBIA

The fine British Columbia Real Estate Association reports that year-to-date BC residential sales dollar volume was down 20.9 per cent to $46.3 billion, compared with the same period in 2022. Residential unit sales were down 16.3 per cent to 47,508 units, while the average MLS® residential price was down 5.4 per cent to $975,232. (Note that sales are up this July against last July, but study the results from 2021, 2019 and see that we are way down over those Julys.)

Source: BCREA

July 2023 VANCOUVER AND FRASER VALLEY

We told you last year that, as we compare ourselves in 2023 to the same months in 2022, we will look great! The market collapsed last year – now it has recovered? Yes – somewhat.

Note: Vancouver SF homes are up 29% with 685 sales … why?

Because last year in July we performed at an anaemic 531 sales rate.

In July 2021 we had 1,050 sales… So, Beer? Yes! Champagne? Not yet!

Vancouver and Fraser Valley

VANCOUVER

NOTE: Vancouver SF new listings are up 9% (Actives still down).

Condo new listings are up 20%.

Fraser Valley SF new listings are up 24%, condos up 28%.

Sales of SF homes are still lower than 2021 or 2019. Sales of condos lower than 2021.

(AGAIN: We left out JULY 2020 because of covid. So, we put JULY 2019 instead!)

Below we are looking at a 4-year JULY 2023 over JULY 2022/2021/2019 comparison.

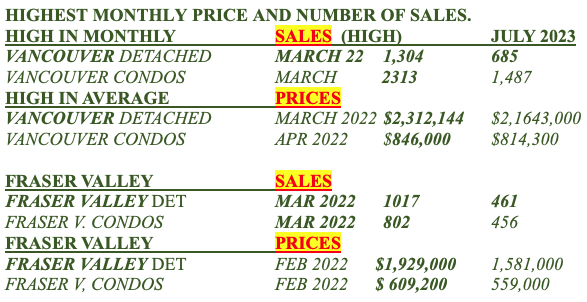

VANCOUVER

Single Family

- Major Point: SF sales are up 29% over 2022 (531) Still sharply lower than 2021. (1,050)

New listings are UP 9% in SF homes, UP 20% in condos. - Vancouver and Fraser Valley all Prices best July in last 4 years!

- But still behind highest monthly prices achieved in last 4 years (see above)

The Vancouver and Fraser Valley Real Estate Boards have the BEST current statistics.

Get your professional realtor give you the numbers for the sub-area that YOU are interested in.

FRASER VALLEY

Single Family

- Major Point: SF Sales are up a whopping 82% over 2022. Still 18% lower than 2021.

- New listings – are up 9% in condos; surprisingly and also up 9% in SF homes. Markets in the Valley are more active overall…

Since March we said every month: We have started bottom building. Investors … WAKE UP! You woke up… We are still not back to 2021 volumes but nicely recovering from the doldrums of 2022. Except for the continued interest rate increases… Investors, this is slowly becoming YOUR market!

MAJOR, MAJOR POINT:

We said new rates will bite. And they are biting. Buy with caution … rising rates are not going to come down and recession early next year or sooner is a given.

21 INQUIRIES COMMENTS ‘Female vocals’ MUSIC – where are the male vocals?

Subscriber asks: How about best Rock n roll – Male vocals – (band at least 10 years old)

OK, here goes – totally biased…(let me know what you like… )

MUSE – Map of the Problematique

https://www.youtube.com/watch?v=Nw5AMCEiZms

MUSE – Undisclosed desires of my heart

https://www.youtube.com/watch?v=R8OOWcsFj0U

(Bliss, Sing for Absolution – oh, just everything)

PEARL JAM – I am Alive

https://www.youtube.com/watch?v=0unH11yjklE

METALLICA – Nothing Else matters

https://www.youtube.com/watch?v=tAGnKpE4NCI

DEPECHE MODE – Enjoy the silence

https://www.youtube.com/watch?v=aWGzr-kOoQY

LINKIN PARK – What I’ve done

https://www.youtube.com/watch?v=_c1w056MItU

RAMMSTEIN – Du Hast

https://www.youtube.com/watch?v=W3q8Od5qJio&list=RDEMNfxU2Vk5xtTODj0ixpqOsQ&index=1

30 SECONDS TO MARS –

https://www.youtube.com/watch?v=GbEWM4KSEt8

ROBBIE WILLIAMS –

https://www.youtube.com/watch?v=cI0Pov_dIgg

ROD STEWART – I don’t want to talk about it

https://www.youtube.com/watch?v=zcP8xLmTKmw

ELTON JOHN – Saturday night is for fighting

https://www.youtube.com/watch?v=26wEWSUUsUc

ROY ORBISON – You got it…

https://www.youtube.com/watch?v=lvR1YgT7QYs

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Hi Ozzie,

Question: What are your thoughts on the Edmonton market? People are migrating to Alberta and you can see the Calgary market taking off as a result, but Edmonton remains in the doldrums. I’d like to eventually sell my Edmonton home and move to BC, but the rest of the world has left this market (Edmonton) in the dust, making a move unaffordable unless or until something changes. I could have sold my home in 2006/2007 for far more than what it will fetch today. It sure would be nice to see some sort of reversion to the mean/norm (whether that means Edmonton prices catch up to the rest of the world, or the rest of the world falls back closer to Edmonton prices?

Thanks

Roland